Having a reloadable prepaid card allows you to ensure that you can only spend what is in your account.

The BPI ePay Visa and Mastercard can be reloaded so you can continue using them for purchases.

If you want to know how to load BPI ePay card using GCash, check out the details in this article.

Table of Contents

How to load BPI ePay card through GCash

There’s no direct way to do this. We’ll have to transfer the money first to your BPI app then load the ePay card through there. Follow these steps:

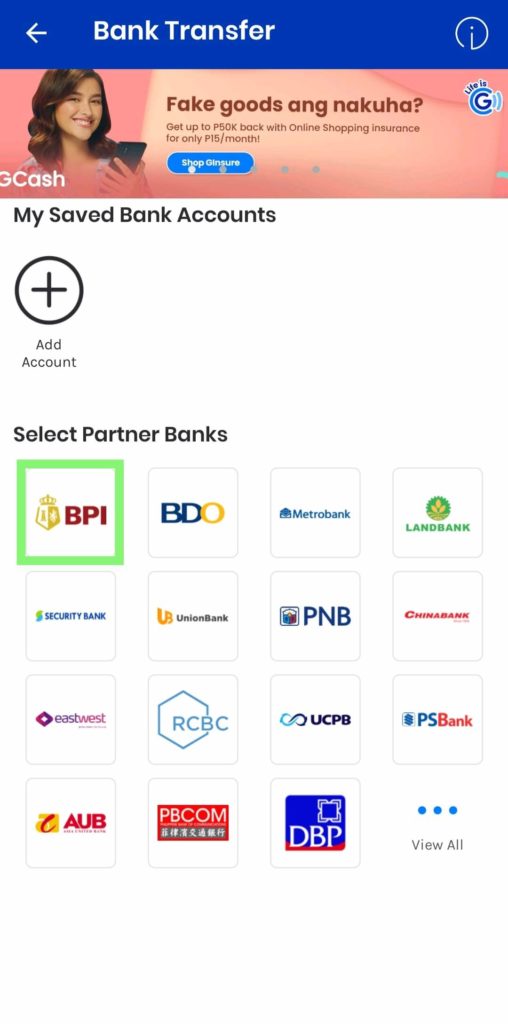

Step 1: Open the GCash app and tap the Bank Transfer button.

Step 2: Under Select Partner Banks, click the BPI logo.

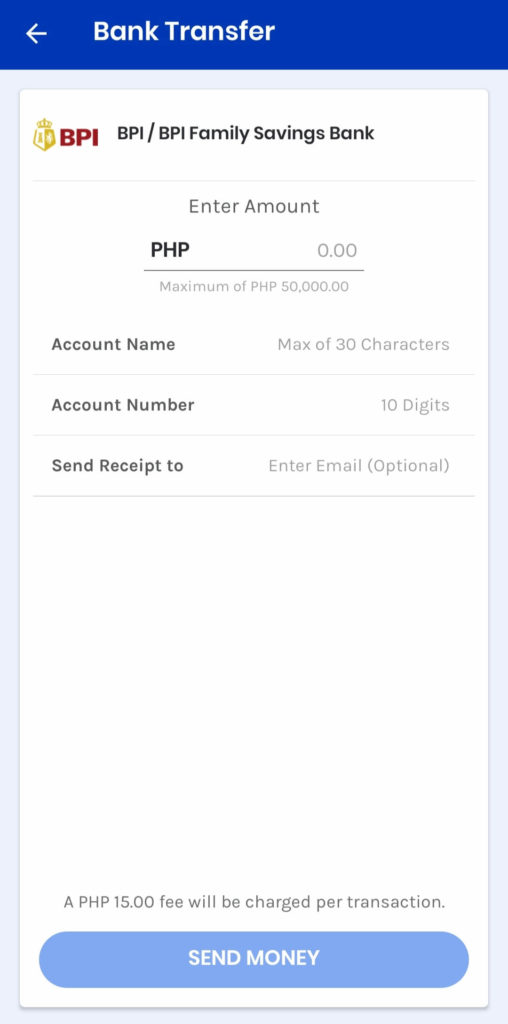

Step 3: Enter the amount, account name, account number, and email (optional).

Step 4: Check the details and confirm your transaction.

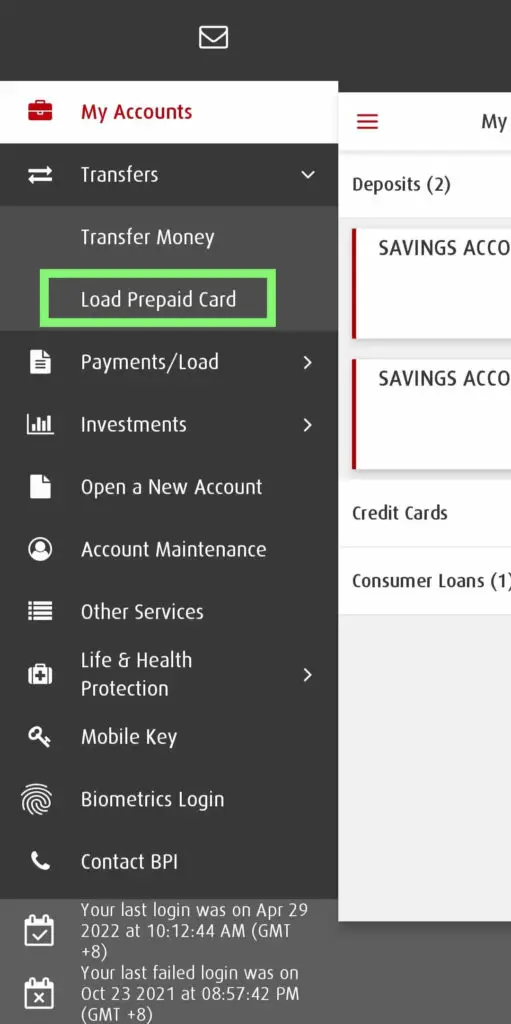

Step 5: Open the BPI Mobile app on your smartphone and select Load Prepaid Card from Transfer.

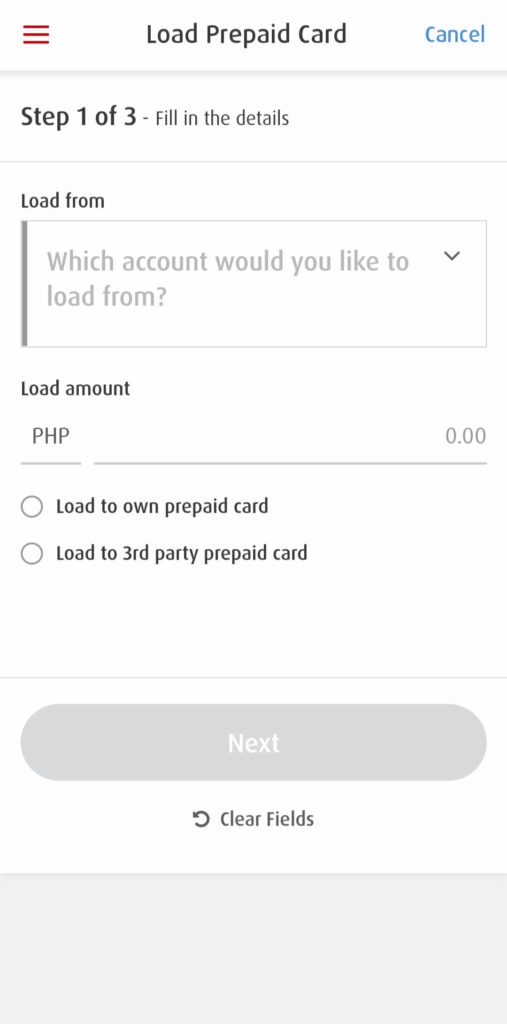

Step 6: Provide the details and click Next.

Step 7: Request your OTP and submit it.

You can now check if the amount is transferred to your BPI ePay card account.

How to check the balance of BPI ePay card

In order to check the balance of your BPI ePay card, follow these instructions:

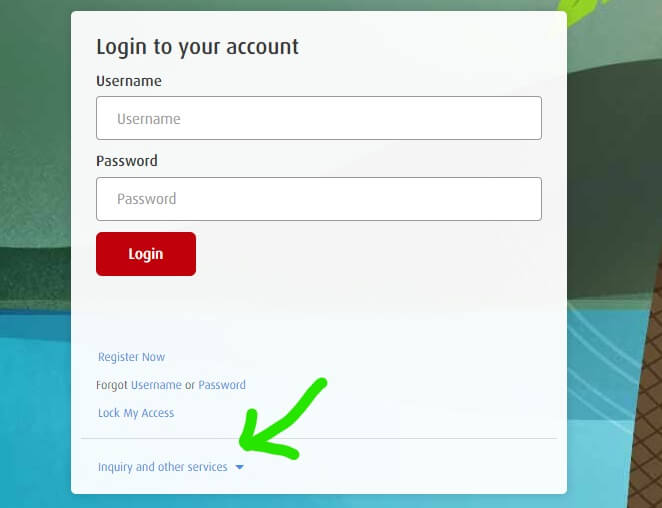

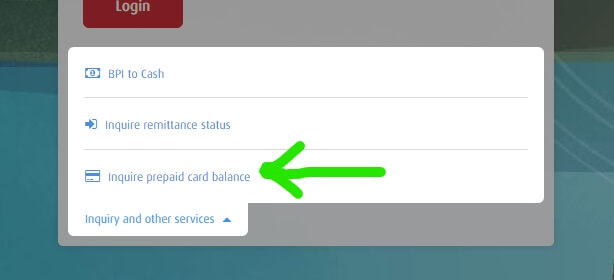

Step 1: Go to the BPI Online website and click Inquiry and other services at the lower portion of the login box.

Step 2: Click Inquire prepaid card balance.

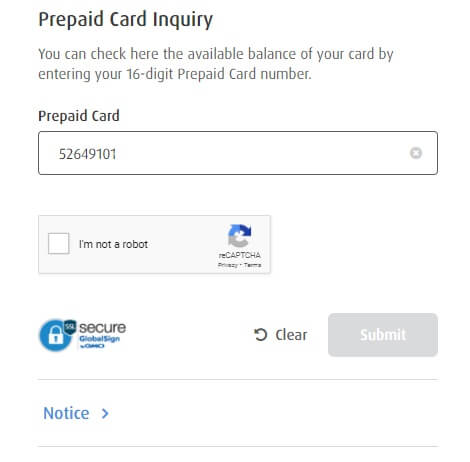

Step 3: Enter your prepaid card number.

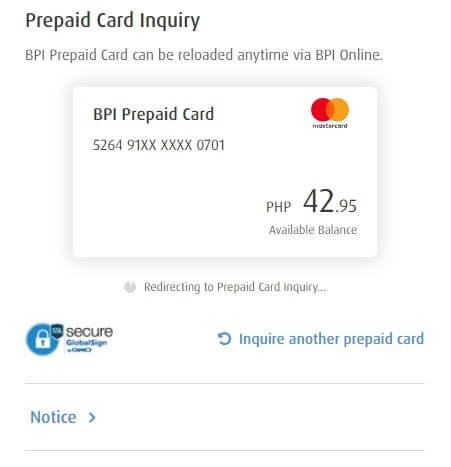

Step 4: Solve the captcha and click the Submit button and you should see your balance then.

You can also bookmark this link for your convenience.

Alternatively, you can check the balance through BPI ATMs, or the BPI Contact Center at 889-10000.

What is the BPI ePay card?

The BPI ePay card is a prepaid card being issued by BPI that you can use for cashless transactions.

It is available in three options: BPI ePay Visa, BPI ePay Mastercard, and BPI ePay Gift Card.

Both cards have EMV for extra security so you do not have to worry about skimming devices.

Is there a fee to reload BPI ePay card?

It is free to reload your BPI ePay card such as through BPI Online, BPI Mobile app, or cash acceptance machines.

But if you are loading through GCash, there is a P15 fee per transaction.

How can I get BPI ePay card?

Follow these steps on how to get a BPI ePay card:

Step 1: Visit the BPI ePay application site.

Step 2: Select your province or city as well as the branch location from the drop-down menus.

Step 3: Click the Proceed button.

Step 4: Read the Terms and Conditions.

Step 5: Tick the box signifying you agree, and solve the captcha to proceed.

Step 6: Enter your personal information as Customer Information and click Proceed.

Step 7: Check the application summary and click the Submit button.

You can claim your BPI ePay card at the BPI branch that you selected in your application after 7 banking days or 10 banking days for those outside Greater Metro Manila Area.

Take note that on May 23, 2022, BPI will no longer issue any of the BPI ePay Mastercard, Visa, or Gift Cards.

It means that you should be able to claim your ePay card until May 22, 2022.

FAQs

What is the maximum amount of funds for BPI ePay?

Both the BPI ePay Mastercard and Visa can have a maximum of P100,000 balance.

The BPI ePay Gift has a lower limit of P20,000.

You can load your card multiple times per day as long as the balance limit is not reached.

However, there is a monthly reload limit of P500,000 per person regardless of their number of ePay cards.

How many times can I load my BPI ePay card?

If you have the BPI ePay Mastercard or Visa, there is no limit as to how many times you can load them.

But if you have the BPI ePay Gift Card, it can only be loaded once.

Where can I use my BPI ePay cards?

You can use your BPI ePay Mastercard and Visa at corresponding affiliated merchants and websites worldwide.

On the other hand, you can only use your BPI ePay Gift Card at Mastercard-affiliated establishments in the Philippines.

You can also only do ATM withdrawals for the BPI ePay Mastercard and Visa.

Can I still use my BPI ePay card after May 23, 2022?

Yes, you can still use any of the BPI ePay cards that you have even after May 23, 2022 as long as they are not yet expired.

Can I replace my existing BPI ePay card?

Yes, you can replace your existing BPI ePay card if it is about to expire or have already expired.

Don’t forget though that you can only do so until May 22, 2022.

What happens after my BPI ePay card expires?

Once your BPI ePay card expires, you can no longer use it nor withdraw the remaining amounts.

You can only cash out the remaining funds by requesting a manager’s cheque with a P100 fee.

What are the valid IDs accepted by BPI?

You can present any of these IDs when claiming your BPI ePay card:

- Alien Certificate of Registration or Immigrant Certificate of Registration

- Baranggay Certification

- BSP, SEC, or IC-registered company ID

- Driver’s license

- DSWD Certification

- GOCC ID

- GSIS e-Card

- ID issued by the National Council on Disability Affairs

- Integrated Bar of the Philippines ID

- MARINA ID

- NBI Clearance

- OFW ID

- OWWA ID

- Passport

- PhilHealth ID

- Police Clearance

- Postal ID

- PRC ID

- Seaman’s Book

- Senior Citizen card

- SSS card

- Taxpayer Identification Number (TIN)

- Voter’s ID

Can I link my BPI ePay card to PayPal for online purchases?

Yes, you can link your BPI ePay card to PayPal just like how you would with other cards.

Don’t forget to have a minimum balance of P150 in your account because PayPal will deduct $1 for account linking, and a separate P100 for card verification.

The P100 will be returned to you as PayPal credits.

How much is the cross border fee for BPI ePay card?

There is a cross border fee of 2.5% of the transaction amount when using the BPI ePay card for international transactions in lieu of the Dynamic Currency Conversion Fee which is not yet in effect.

Conclusion

Having a BPI ePay card gives you the advantage of creating a dedicated account for your purchases.

Get one now before time runs out and replenish your funds by sending money from your GCash account.

Read these next:

- How to Open BPI Account: Complete Guide

- How to Cancel BPI Credit Card: Complete Steps

- How Much is the Maintaining Balance in BPI

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023