Purchasing products online has been trending nowadays even COVID-19 happened. Modes of payment also varies since it can be cash on delivery (COD), credit cards, debit cards, online payments like GCash were already available.

GCash has become popular these days because it offers lot of perks for every user. The fact that it has cashbacks when you buy load, discounts when you purchase online, and even insurance.

Availing an insurance is one of the best approaches to remain financially secured for emergencies and unpredicted circumstances. This is to spare bank accounts or savings from the burden of the losses in emergency situations. Also, it’s a better way to provide individuals a tranquility since insurance plans covers safety and security.

Read more about GCash insurance for you to understand more the benefits of having one.

Table of Contents

GCash Insurance Products

GCash Insurance is an all-inclusive insurance product of the following for GCash users:

Life Insurance

Life insurance of GCash covers death which is very hard to experience. This is not to burden the family and dependents anymore in terms of financial issues.

Personal Accident (PA) Insurance

Accidents that we know can happen anytime and anywhere that may lead to serious injury. Availing this Personal Accident insurance covers the hospital bills, recovery, and overall monetary support.

Daily Hospital Income (DHI) Insurance

Once you get this type of insurance, it will cover your financial expenses on your hospital stay or on your admittance on the hospital once you get ill.

It is an advanced plan that is beneficial for the GCash user as it provides advantageous protection financially in a way that it can cover an incident of:

- Accident

- Hospitalization

- Death

Who can avail GCash Insurance?

In order for you to avail GCash Insurance, you need to be:

- Fully verified on your GCash mobile application

- Between 18-64 years of age

Possible Dependent under Family Products

For married users, they can nominate the following dependents:

- Legal husband/wife who is not older than 64 years old

- Children between 3 – 21 years old.

For single users, they can nominate the following dependents:

- Parents who are not older than 64 years old

- Siblings between 3 – 21 years old.

When you enroll your dependent in case you want to avail under Family products, just provide any proof of relationship on your dependent like the following documents below:

- Marriage certificate (for spouse)

- Birth certificate (for parents, siblings)

How do I claim GCash insurance?

GCash made it easier for you to avail this insurance since it is paperless. This means that you don’t need to fill up anything using a pen and paper. All you need to do is to have a verified GCash account.

Select your preferred insurance product and text the code to:

- 2158-9628 (for Globe users)

- 22565-9628 (for non-Globe users)

Note that you must complete the following to process your insurance:

- Fully verified GCash user to be able to apply for any type of GCash insurance.

- Correctly text the code (spacing and capitalization) and send it to correct number.

- GCash wallet has enough balance since payments will be automatically deducted from your existing balance.

- Your payment for the insurance will be processed within the next 1-2 business days.

When will my coverage for GCash Insurance start?

Your coverage under GCash Insurance starts once you receive a text message after 1-2 days of processing time.

Coverages, Benefits and Monthly Payments Under GCash Insurance

For those who want to avail their insurance plan individually, you may check the following below:

| Insurance | No. of people insured | Monthly Payment | Product Tier | Term Coverage | Term Life/Personal Accident Coverage (Per Person Insured) | Hospital Cash Coverage* (Per Person Insured) |

| INSUREME39 | (1) GCash User | P39 | Bronze | Annual | P 25,000 | Up to PHP 750. Pays PHP 250 per days up to max 3 days hospitalization |

| INSUREME78 | (1) GCash User | P78 | Silver | Annual | P 50,000 | Up to PHP 1,500. Pays PHP 250 per days up to max 6 days hospitalization |

| INSUREME220 | (1) GCash User | P220 | Gold | Annual | P 100,000 | Up to PHP 5,000. Pays PHP 250 per days up to max 20 days hospitalization |

| INSUREME440 | (1) GCash User | P440 | Platinum | Annual | P 200,000 | Up to PHP 10,000. Pays PHP 250 per days up to max 40 days hospitalization |

For those who want to avail their insurance plan as family or with dependents, you may check the following below:

| Insurance | No. of people insured | Monthly Premium | Product Tier | Term Coverage | Term Life/Personal Accident Coverage (Per Person Insured) | Hospital Cash Coverage* (Per Person Insured) |

| INSUREFAM117 | (1) GCash User, (2) family members | P117 | Bronze | Annual | P 25,000 | Up to PHP 750. Pays PHP 250 per days up to max 3 days hospitalization |

| INSUREFAM234 | (1) GCash User, (2) family members | P234 | Silver | Annual | P 50,000 | Up to PHP 1,500. Pays PHP 250 per days up to max 6 days hospitalization |

| INSUREFAM660 | (1) GCash User, (2) family members | P660 | Gold | Annual | P 100,000 | Up to PHP 5,000. Pays PHP 250 per days up to max 20 days hospitalization |

| INSUREFAM1320 | (1) GCash User, (2) family members | P1320 | Platinum | Annual | P 200,000 | Up to PHP 10,000. Pays PHP 250 per days up to max 40 days hospitalization |

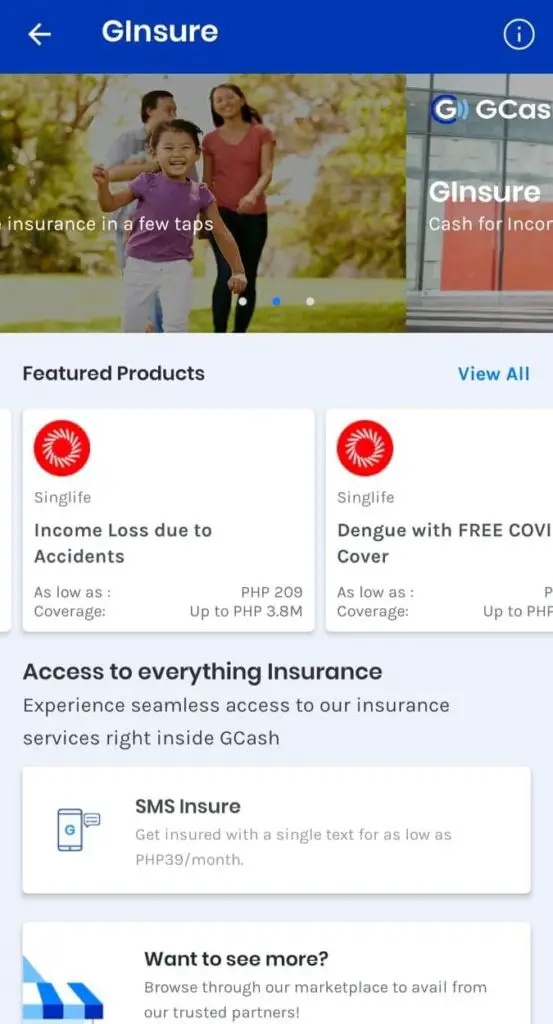

What is GInsure?

Powered by Singlife, GInsure provides you better access to easy-to-use security which is great idea when it comes to saving money because you’re already secured by the time unexpected occurrence comes. Below is the following coverage of GInsure:

- Cash for Salary Loss (Any Cause)

Availing Cash for Salary Loss related to any cause and be financially secured with cash for salary loss at any cause so what you will never feel anxious when time comes.

- Cash for Salary Loss (Accidents)

You don’t need to worry anymore once you apply on this plan. In case of accidents that may happen in the future, with the help of GInsure, you’ll be protected from financial stress. This is cash for salary loss related to accidents that allows you to provide the needs of your family with a continuous monthly income in case you’re not able to work due to accident.

- Cash for Dengue Expenses (with Free COVID-19 insurance coverage)

Get financial assistance related to dengue that can cover medical cost at an affordable protection plan.

Note that only for the first 20,000 customers will be given a chance to have Free COVID-19.

Steps to Register to GInsure

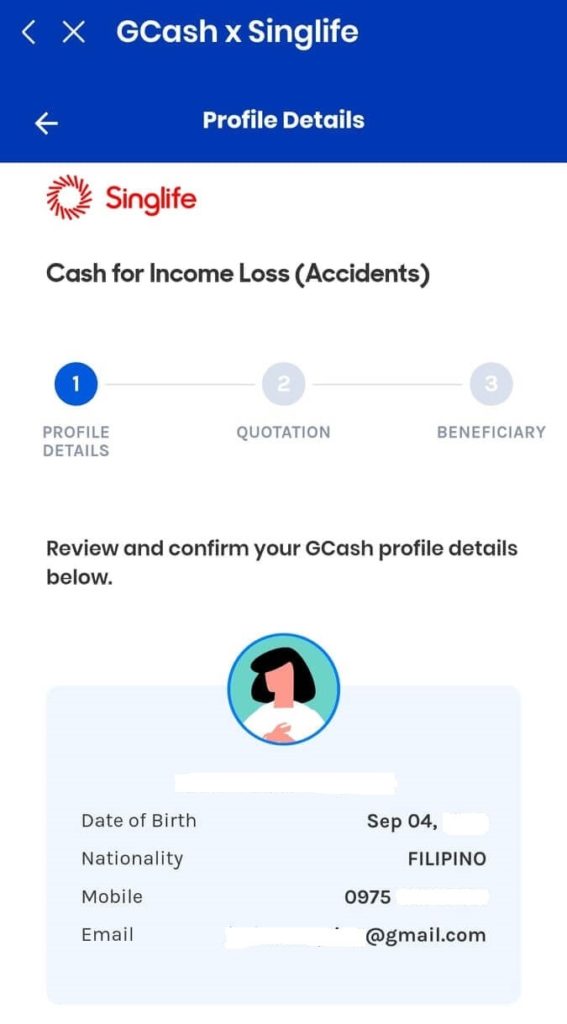

GInsure is the product of Singlife. Here are the easy steps to register to their insurance products.

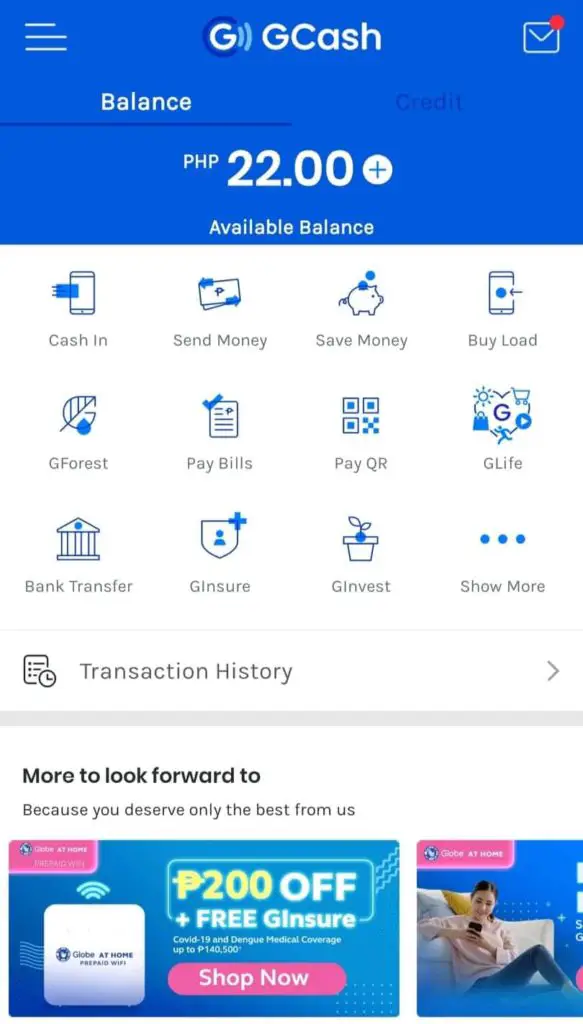

1.Open your GCash app.

2. Select “GInsure”.

3. Select from any Insurance products they have. (See the list above)

4. Tap “Get Started”.

5. Complete all the details on Getting to know you.

6. Complete your profile details.

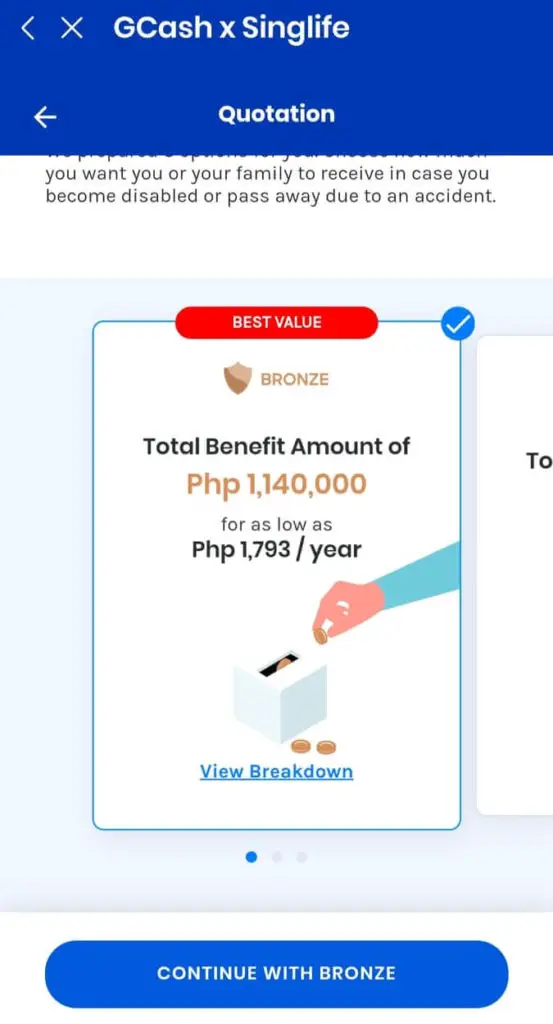

7. You should see a Quotation like this after you’ve provided all the details. You just need to select continue!

What is Singlife insurance in GCash?

It is a mobile app for life insurance that offers protection products without any violation on the bank. Singlife’s mission is to provide tools and answers to your problem which are affordable and flexible.

It comes in handy also since it is a user-friendly application. You can manage your account and money easily since you have the Singlife insurance where you can monitor your accounts and for security purposes also.

It is also reliable application for it is an insurance savings plan where you can save, spend, secured and insured at the same time.

Is GCash Insurance worth it?

If you don’t want any hassle to talk to any agent for insurance, then you have to avail GCash insurance since it is also worth it.

For as low as Php 39.00 monthly, you’ll be able to save expenses in the future once unexpected event happens. This is for emergency situations that for sure is what we don’t want to happen but financially secured is better than getting from your savings.

GCash insurance is affordable that everyone can avail it plus its application process is just easy.

Related Posts:

- GCash GCredit: Get Up to ₱30,000 with 3% Interest!

- How to Delete Gcash Account: 3 Easy Steps to Follow

- How to Get GCash Fully Verified in 7 Easy Steps

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023

3 thoughts on “GCash Insurance: Everything You Need to Know”

Comments are closed.