GCash is a globally recognized micropayment service that turns your phone into a virtual wallet for safe, quick, and easy money transfers.

It is a mobile app that you may download to any of your devices, including your Smartphone or tablet.

GCash may be used to acquire prepaid credit, pay bills, send money, make donations, shop online, and even make purchases without using cash.

Want to manage your money easily? Download GCash now using this link!

Table of Contents

GCash Account Limits (Table)

| Limits | Basic | Fully Verified | w/ Linked Bank | Enterprise |

| Maximum Wallet Size | ₱50,000 | ₱100,000 | ₱500,000 | ₱500,000 |

| Daily Incoming Limit | None | None | None | None |

| Monthly Incoming Limit | ₱10,000 | ₱100,000 | ₱500,000 | ₱500,000 |

| Daily Outgoing Limit | None | ₱100,000 | ₱100,000 | ₱100,000 |

| Monthly Outgoing Limit | ₱10,000 | None | None | None |

| Yearly Outgoing Limit | ₱100,000 | None | None | None |

List of All Gcash Limits

Make sure your GCash account is correctly verified before increasing your gcash limit. GCash allows you to link your bank account or Mastercard card.

After successfully integrating your bank account to GCash, you will receive an SMS confirmation of your wallet gcash limit increase the next day.

Every month, your wallet would be able to hold up to P500,000. With this, you will be allowed to deposit or receive P500,000 every month in your wallet.

You’ll be able to send and receive money in amounts far exceeding the previous monthly restriction of P100,000.

Cash in Limit

Every 30 days, Payoneer allows you to withdraw up to P100,000 from your account. Cash In Gcash limits, on the other hand, continue to apply.

The GCash wallet limit is P100,000 per month because the service is only available to Fully Verified users.

Transaction Limit

Your transaction limits are determined by whether you have Basic or Fully Verified verification. The transaction limit has been raised to P500,000.

Credit Limit

GCredit may provide you with a credit limit of up to P10,000 and a 1% interest rate!

Interest is prorated, which means that the sooner you pay your bills, the lower your interest rate will be.

If you pay your dues early, you can also use your GCredit.

Your credit limit will be increased in proportion to your GScore.

Your GScore determines your credit limit. GCredit will tell you when you are qualified for a higher credit limit.

Withdrawal Limit/Cash-Out Limit

Outgoing limits increased — withdrawals will be unlimited each month, and you can withdraw up to Php 100,00 per day.

Daily Limit

Incoming cash does not have a daily limit. The daily cash withdrawal or outgoing cash limit is P100,000.

GCash Mastercard withdrawal limit amount is Php 500, with a daily maximum of Php 50,000.

If you’ve earned a considerable amount of GCash, you can cash it out at partner locations, transfer it directly to your bank account, or withdraw it with your GCash card from any Bancnet ATM.

Consider GCredit to be a personal credit line for the app.

If you get a GCash limit exceeded error, you can either wait for your limitations to reset next month or use a different GCash account to transact.

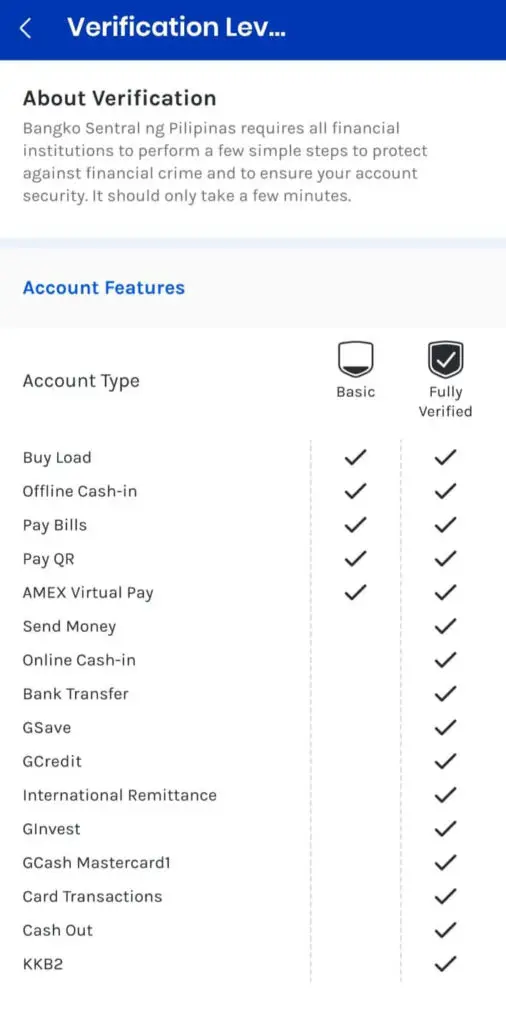

How to See all the GCash Limits and Benefits

If you want to see your current GCash limit, there’s no option yet available for that.

However, you can see the full limits and benefits in GCash by following these steps:

1. Open your GCash app

2. Tap the “Profile” tab on the lower right

3. Select “View Benefits” at the top

4. Here, you should see all the benefits you can get with a Basic and a Fully Verified account plus all the limits.

How to Increase GCash Limit

If you want to increase your GCash limit, you just need to verify your account.

After you verify your account, your wallet limit will increase from P50,000 to P100,000 as well as your incoming limit.

If you want to increase it even more to P500,000, you just need to link a bank account to your GCash.

You can link bank accounts such as BPI and UnionBank or GCash Mastercard.

To do this, open your GCash app > Profile > My Linked Accounts.

What can Gcash be used for?

GCash brings the concept of convenience to a whole new level. Because the app allows you to accomplish so much, it has essentially eliminated the hassles of fighting the heat—or rain—in traffic, as well as long lineups and wasted time.

You may invest more in the things that matter infinitely more: family, friends, passions, and health with the hours you save.

- Save more.

GSave makes money-saving more accessible and straightforward for both banked and unbanked people. GSave doesn’t require you to keep balance, so you don’t have to worry about it.

Furthermore, consumers can earn a 3.1 % interest return on any amount they deposit.

Within the app, you may watch your savings develop quickly. You may also use the GSave tool to plan auto-deposits so that you don’t forget to save regularly.

2. Pay your bills.

Waiting in long lineups at payment centers is no longer a source of anxiety, thanks to GCash.

You can pay off your financial commitments with a single press on your screen.

Without breaking a sweat, you can pay your utilities, credit card bills, government bills, loans, and even education fees using the app.

Related: How To Pay PLDT Using GCash in 6 Easy Steps

3. Make a movie reservation.

Gain control of your leisure time by booking a seat at any of our partner cinemas as early or as late as you wish.

Skip the line and head straight to your favorite Ayala Malls, SM Supermalls, and Uptown Bonifacio theaters.

4. Make a Tree

By gathering energy points to plant additional trees and contribute to the country’s natural resources, you can make every day Earth Day with GForest.

5. Cash Out/Withdrawal of Funds

If you’ve accumulated a considerable amount of GCash, you can cash it out at partner locations, transfer it directly to your bank account, or withdraw it with your GCash card from any Bancnet ATM.

6. Money transfer

You can send money from your digital wallet to any partner bank using the Send Money to Bank Account tool, eliminating the need for numerous banking apps.

The fee of sending money by bank transfer is Php15.

Meanwhile, GCash allows you to send money to another GCash wallet without incurring any additional fees, regardless of which network you’re on.

7. Purchase Load

Do you have a low load? You can add money to it using the GCash app! Purchase load for any network, and you could get a 5% cashback!

You may buy load combos, gaming pins, and even broadband packages in addition to the prepaid load.

Read more: GCash Rebate: Get Back 5% When You Buy Load

8. Make use of GCredit.

Consider GCredit to be a personal credit line for the app. You can use it to pay your bills or shop now and pay later at partner retailers.

However, this function is only available to fully authenticated users who have improved their GScore to a particular level—so use the app frequently!

Your transaction limit will increase as you make more transactions.

Know more: GCash GCredit: Get Up to ₱30,000 with 3% Interest!

9. GLife – Shop Online and Order Food

You may order food online or shop without downloading your merchant’s online shopping app with the GCash app.

For example, if you need to buy something from Lazada, you can shop within the GCash Lazada mini-app without visiting or downloading the app.

10. Borrow Load

If you’re short on digital cash but need the load right away, you can use the app’s Borrow Load option.

You’ll have two days to repay the money without incurring any interest or service charges.

11. Purchase in-store.

In addition to online purchasing, you may use your account to pay for in-store purchases at over 73,000 GCash merchants.

Enjoy the convenience of being cashless when shopping; scan the store QR code to pay with GCash when purchasing food, groceries, clothing, and other items.

12. GInsure

On GInsure, you may get protected, buy, and manage retail insurance products for as little as Php300 per year.

You can keep prepared for emergencies and live worry-free without breaking the bank with that amount. You are not required to complete lengthy forms or processes.

You may apply and select the sorts of insurance you need in minutes if you have a verified GCash account.

Read more: GCash Insurance: Everything You Need to Know

13. GInvest

GInvest provides a faster account verification process than banks and is more inclusive.

With GInvest, all you have to do is get your account validated and invests a minimum of Php50.

You may sell and buy using your GCash wallet, and there are no commissions or sales fees.

Conclusion

Now that you know the GCash limits, it’s time that you check what limit you’re currently at!

Related posts:

- How to Get GCash Fully Verified in 7 Easy Steps

- GCash Referral Code: How to Earn Money

- How to Delete Gcash Account: 3 Easy Steps to Follow

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023

What happened to the money I’ve sent to a gcash account that have exceeded its limit? The recepient said she haven’t received the money and it has been more than 7 days and I haven’t received the money back also.

Hi Rose,

If this is the case, you should contact GCash customer support ASAP. You can do it in the app or you can contact their hotline 2882. You should be able to provide the details and screenshots if there are any so they can help you.