What exactly is GInsure Bill Protect?

You might wonder what this new feature you see when paying bills in GCash is all about.

You’ve come to the right place as you’ll know what it is, the coverage, fees, and how to claim.

Table of Contents

What is GInsure Bill Protect?

GInsure Bill Protect is a group insurance offered by GCash that offers protection to the bill payer in case of a permanent disability or accidental death.

It aims to help the insured user settle his bills for 36 months (3 years) from the time of the bill payment.

Who Can Avail GInsure Bill Protect?

Anyone can avail of the GInsure Bill Protect policy as long as they meet these requirements:

- 18-75 years old

- Verified GCash account

- Filipino citizen or legal Philippine resident

- Will pay a biller in GCash

GCash also clarified that the GCash-registered person who pays the bills is the one insured. So, even if you pay the bill of your family, for instance, it will be you who’s insured, not the name on the bill.

GInsure Bill Protect Coverage and Fee

The way the GInsure Bill Protect works is first, the user pays a bill and subscribes to the insurance. That is then considered as one insurance policy valid for thirty days.

Users can then pay as many bills and subscribe to as many policies as possible to get a bigger lump sum. Provided that the incident date still falls inside all the insurance policies (30 days).

When you subscribe to GInsure, the premium is computed as Bill amount X 0.920%.

Here’s a sample computation:

| Bill payment – PLDT | P2,000.00 |

| + GInsure Premium (0.920% of the bill) | P18.40 |

| = Total amount to be paid | P2,018.40 |

Suppose the insured user has had an accident; the benefit will be:

Bill amount: P2,000 X 36 months = P72,000

This is just one policy. Imagine if he had more policies that covered the date of the accident, he could get a bigger lump sum benefit.

How to Avail GInsure Bill Protect

You can only avail GInsure Bill Protect when you pay for your bill in GCash. Here’s how:

Step 1: Open your GCash account and go to Bills

Step 2: Select from the categories the type of bill you want to pay

Step 3: Choose the biller

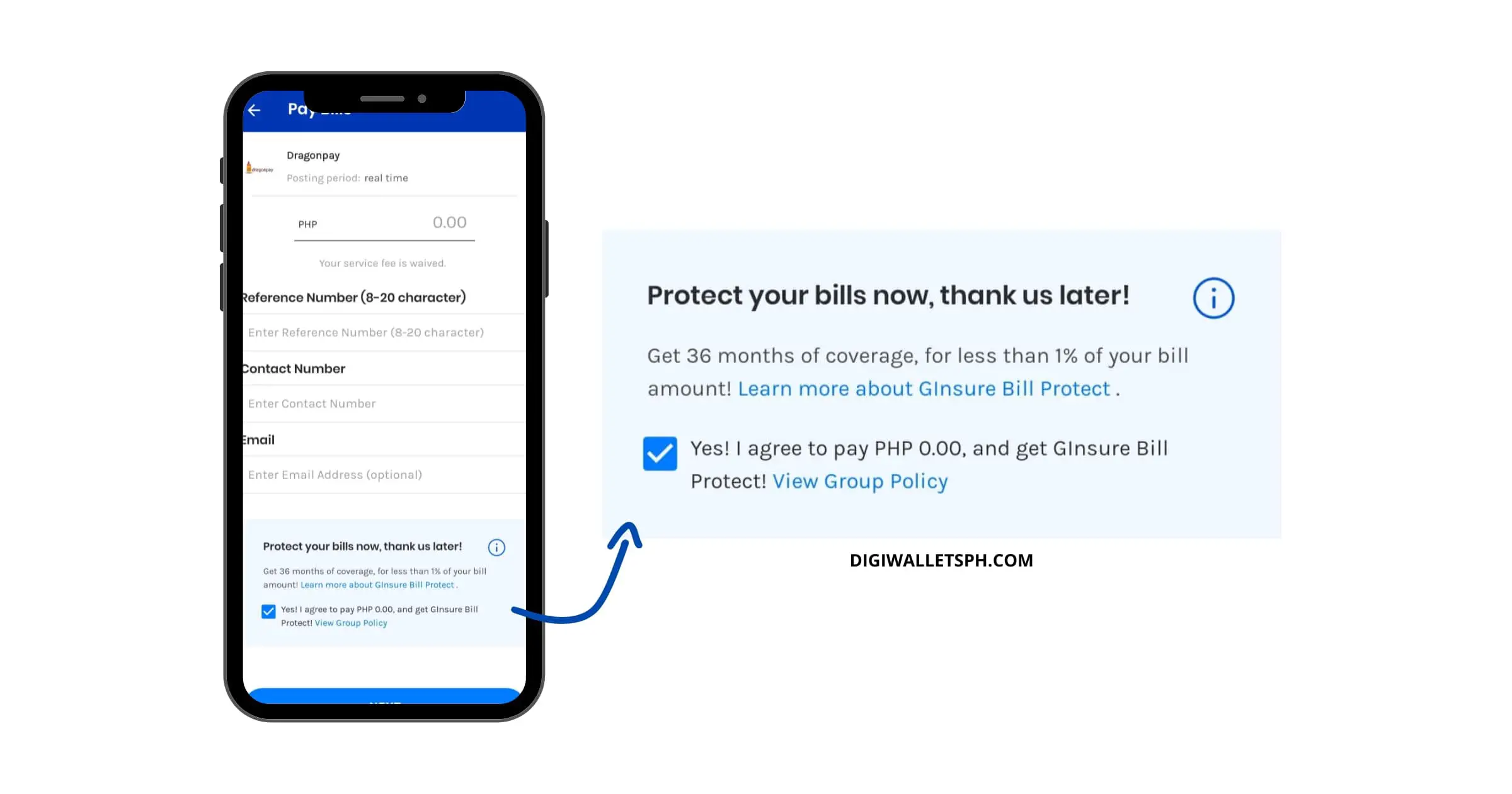

Step 4: Enter the amount of the bill, account number, contact, etc., and check GInsure Bill Protect below

Step 5: Pay for the bill using your GCash balance or GCredit

Once you’ve completed this process, you’re now a GInsure Bill Protect policy owner. This is valid for 30 days from the date of the bill payment.

How Can I Cancel GInsure Bill Protect

If you want to cancel your insurance coverage, you can only do so within 7 days after you paid your bill. You can request this by submitting a ticket in GCash.

Once you cancel your policy, you won’t get a refund. So, we suggest you don’t cancel it because it’s what you paid for. Besides, the policy only covers 30 days anyway.

But if your question is how not to avail GInsure Bill Protect, uncheck the GInsure dialog when you’re about to pay your bill.

How to File a Claim with GInsure Bill Protect

You or any beneficiary can claim your benefit in case of accidental death or permanent disability. Here’s how:

Step 1: Make sure that your GInsure insurance policy covers the accident’s date within 30 days.

Step 2: Prepare the requirements:

- Valid ID of the insured (GCash user) or the valid ID of the beneficiary

- Birth and death certificates of the insured

- Attending physician’s report

- Proof of relationship to the beneficiary

- Autopsy Report/Medico-Legal Statement

- Original copy of police report

- Notarized affidavit of witness

Step 3: Submit your claim at Chubb Claims Centre

Step 4: Wait for their confirmation

If your policy covers the accident, you should expect a payout, as mentioned earlier.

In case of death or unavailability to claim, your beneficiary can be any of the following:

- Legal spouse

- Children

- Parents

- Siblings

FAQs

Is GInsure Bill Protect free?

No. You’ll pay for the premium when you pay your bill in GCash. It’s computed as follows: Bill amount X 0.920%.

It’s a group insurance, so the premium is cheap, but the benefits are high, which is the bill amount X 36 months.

Is there a limit to how many GInsure Bill Protect policies I can avail of?

No, you can avail as many GInsure Bill Protect policies as you want. You can pay as many bills as possible and get a bigger lump sum in case of accidents.

Can you avail Ginsure with any types of bills in GCash?

Yes, all types of bills are supported with GInsure Bill Protect. This includes electric, Water, Cable/Internet, Telecoms, Credit Cards, Loans, Government, Insurance, Transportation, Real Estate, Healthcare, Schools, Payment Solutions, and more.

Final Thoughts

It wouldn’t hurt to avail GInsure Bill Protect if you have the extra money. Besides, you would only pay below P100 as a premium depending on your bill.

It’s a great deal and can help pay for your bills in emergencies.

Read these next:

- GCash Insurance: Everything You Need to Know

- GCash Rates: Fees, Interest & Charges

- How to Pay Home Credit via GCash: Full Guide

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023