Did you know that GCash now has over 60 million users in the Philippines? It may be obvious by now because even Taho vendors accept GCash payments.

But even so, if you’re new to the digital wallet or want to learn more about its features, you’ve come to the right place.

You’ll learn how to download, create, and verify your account here. You’ll also know surprising features and tricks you didn’t know existed in the app!

Table of Contents

What is GCash?

GCash is a digital wallet owned by Mynt, under Globe. GCash was created in 2004 to provide features like donations, loan settlements, remittances, and more through text messages.

But in 2012, the GCash app that we know today was launched. Since then, it has undergone many changes from the design to the features.

Now, the app is the leading digital wallet with 60 million users and counting. Its most popular rivals include PayMaya and Coins.ph.

Step 1: How to Download the GCash App

Before you use it, you first need to download the app. It’s available for iOS and Android users. You can get it from Google Play Store or App Store.

Simply download the GCash app using our link. (Note: This is a referral link. We may get a commission when you download GCash, which we’ll use to maintain the site)

Or you can head to your app store, search for “GCash,” and download it. Then, install it on your device.

Step 2: How to Create a GCash Account

After you download the app, you can now create an account. You can only create one GCash account per number. But you can create up to 5 accounts per person.

Follow the steps below to create one:

Step 1: Enter your mobile number

Step 2: Enter the OTP code sent to your number

Step 3: Input your info like the first name, middle name, last name, birthday, address, and email

Step 4: Next, set your 4-digit mobile PIN

That’s it, you can now access the basic features of the GCash app. To use it fully, you’ll need to verify it.

Step 3: How to Verify Your GCash Account

You can still access your GCash account without verifying it. But you’ll be limited in the features. You won’t be able to send or receive money, cash out your money or even cash in.

On the other hand, verifying your GCash account makes you eligible to use all the features.

Here’s how you can verify your GCash:

Step 1: Open your GCash app and go to the Profile tab

Step 2: Tap the Verify Now button just under your profile picture

Step 3: Select the Get Fully Verified button

Step 4: Select the valid ID that you have, such as UMID, driver’s license, Philhealth ID, SSS, Passport, and Voter’s ID

Step 5: Take a photo of your ID using your phone’s camera and submit

Step 6: Then, take a selfie verification and confirm all the information you submitted

It typically takes less than 5 minutes to do all the steps listed. Now, you just need to wait for GCash to verify it.

If there’s no problem, it can be verified in a day. Otherwise, you can wait up to 3 business days.

Step 4: How to Use GCash

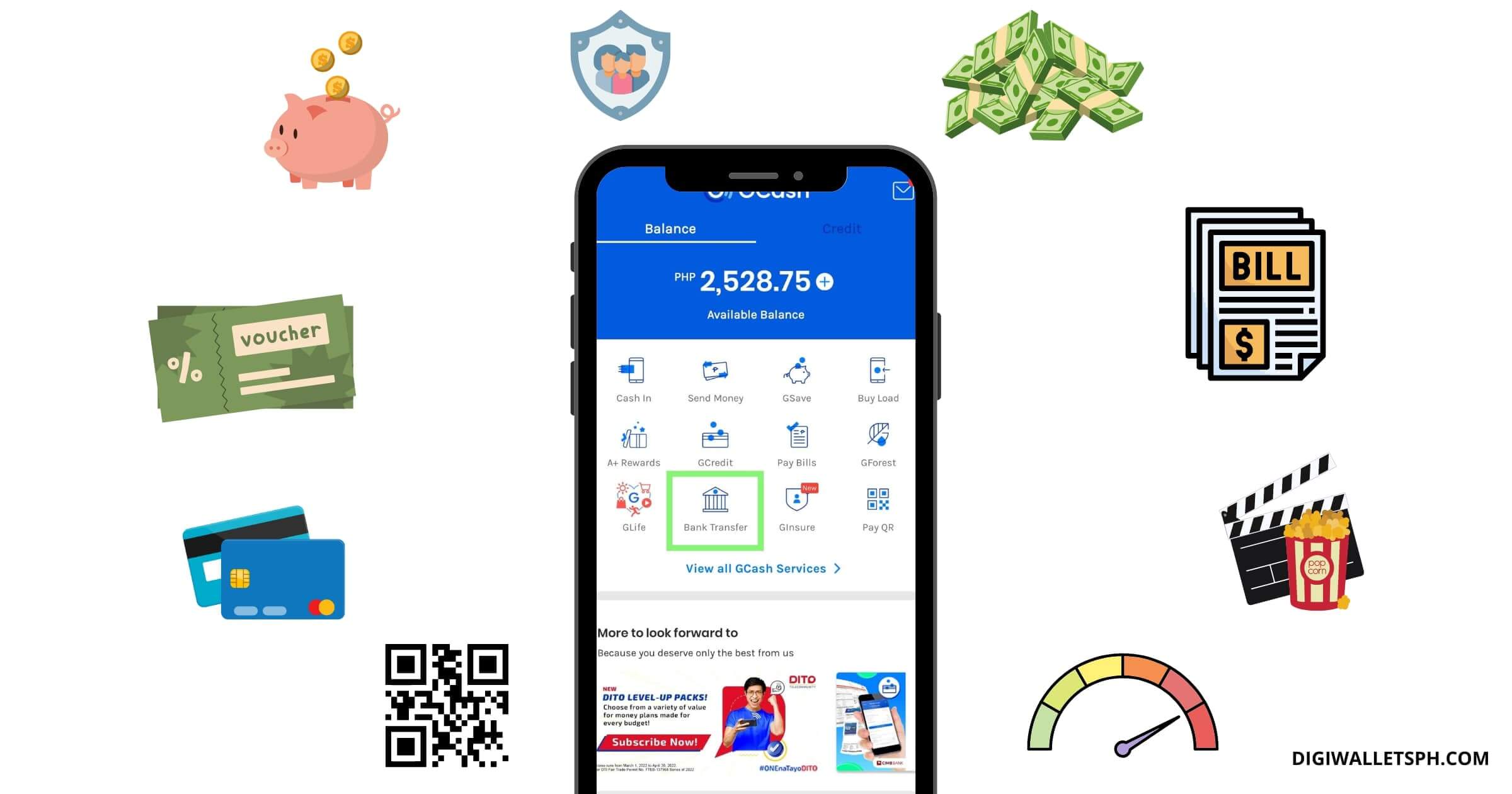

The next step is to know how to use the app. Assuming your GCash account has just been verified, there are a lot of features you can access.

To use the app, open it > enter your number and MPIN > you can now use GCash.

There are many features inside GCash that you can use. The five main tabs are the Home, Inbox, Pay QR, Activity, and Profile.

Complete Features of GCash

Over the years, GCash has upgraded its services with more features. Now, it has a lot of interesting services that we can conveniently access anytime.

In this section, we’ll get to know each feature individually.

Send

Selecting this tab from home lets, you access many features like:

- Express Send

- Send via QR

- Send with a Clip

- Send Gift

- Bank Transfer

- GCash Padala

- Generate QR

- Request Money

- KKB

With GCash, you can send money to any GCash user for free in real-time using Express Send and the three other methods.

Then, Bank Transfer allows you to send money from GCash to any banks or digital wallets.

GCash Padala lets you send money to users without GCash accounts. They can claim the money through GCash Padala partners like Posible, Tambunting and pera outlets.

There are limits to sending and receiving money in GCash. The limit depends on your level. Here’s the table:

| Basic | Fully Verified | GCash Jr. | GCash Plus/Enterprise | Platinum | |

| Sending money | ₱10,000 monthly | No limit | ₱10,000 | No limit | ₱1,000,000 |

| Receiving money | ₱10,000 | ₱100,000 | ₱10,000 | ₱500,000 | ₱1,000,000 |

We’ve also created a guide for the complete list of GCash limits.

Load

GCash has a feature where you can buy load for various networks. First, there’s the Telco load which allows you to buy load for the following networks:

- Globe

- TM

- Smart

- DITO

- GOMO

- Cherry

- TNT

You can buy regular load as well as enjoy promos with different bundles.

Then, you can also buy Broadband load for PLDT Home, Smart, Globe Business, and Globe.

Lastly, Lifestyle Load allows you to buy load for:

- Game credits (Garena, Steam, Razer)

- KUMU

- MARINO

- PAYTV

- CIGNAL and Satlite

- Tinder

- Prepaid Insurance (Maxicare, Cebuana Lhuillier, Konsulta MD)

Transfer

The bank transfer feature lets you send money from GCash to any bank account. It allows you to send money to BPI, BDO, Landbank, PNB, RCBC, and more.

You can also send money with other digital wallets/apps like Coins.ph, PayMaya, Lazada Wallet and more.

Users can also save bank accounts in this tab for easy access. You can name the saved account and easily access it.

Bills

Paying bills has become easier with GCash. You can pay a variety of bills here like:

- Electric Utilities

- Water Utilities

- Cable/Internet

- Telecoms

- Credit Cards

- Loans

- Government

- Insurance

- Transportation

- Real Estate

- Healthcare

- Schools

- Payment Solutions

Like the bank transfer, you can also save billers here. This will allow you to pay your bills easily as the details are already saved. You can also set up reminders to pay your bills.

Borrow

GCash allows you to borrow money through 3 main services: GCredit, GLoan, and GGives.

Here are the details and differences between each:

| GCredit | GLoan | GGives | |

| Interest rate | 5% per month | 2.6% – 4% per month | 2% – 5% per month |

| Amount available to loan | Up to ₱30,000 | ₱5,000 – ₱50,000 | Up to ₱30,000 |

| Purpose | To be used to pay bills, shop online, and more | Can be withdrawn as cash | Perfect for offline installment plans through Pay QR |

GSave

To save money, you can open a bank account through MySaveUp by BPI and GSave by CIMB.

GCash has partnered with these banks to help users create a savings account in the app.

GSave by CIMB lets you earn a 2.5% interest rate per annum on your savings. Both features allow you to deposit and withdraw your money through your GCash app.

GInsure

GCash also offers different types of insurance with affordable premiums. Available in the app are:

- Health insurance

- Personal insurance

- Accident insurance

- Property insurance

- Pet insurance

- GInsure Bill Protect

GCash has partnered with many insurance companies to make this possible. This includes partnerships with SINGLIFE, FPG insurance, Pru Life UK, Cebuana Lhuillier, Kwik.Insure, BPIMS, Standard Insurance, and more.

For as low as ₱79 per month, you can get health insurance coverage of up to ₱750,000!

You can check out our complete GCash insurance guide now.

GInvest

One of the recent features from GCash is the GInvest, where anyone can start investing for as low as ₱50. They let you invest in different ways, such as stocks, bonds, money market funds, etc.

Here’s the list of the available investments you can buy as well as the minimum amount you can buy:

| Investment | Minimum Investment |

| ALFM Global Multi-Asset Income Fund | ₱1,000 |

| Philippine Stocks Index Fund | ₱50 |

| ATRAM Peso Money Market Fund | ₱50 |

| ATRAM Global Consumer Trends Fund | ₱1,000 |

| ATRAM Total Returns Peso Bond Fund | ₱50 |

| ATRAM Philippine Equity Smart Index Fund | ₱50 |

| ATRAM Global Technology Feeder Fund | ₱1,000 |

To start investing, simply have enough cash on your GCash balance and head on to GInvest. Select the amount you want to invest and wait for around 2-3 business days for your investment to be confirmed.

You can check your investment product to see how it’s doing daily on the GInvest dashboard. But it’s not updated in real-time, unlike the PSEI or stock exchange platforms.

Withdrawing your funds is also done inside GCash, and it will be credited to your balance.

GLife

Glife is a feature that lets you access different shopping apps and websites all in one place. There are various deals you can get as well as enjoy doing the following:

- Shop

- Order Food

- Play Games

- Watch & Experience

- Services

- Manage Finances

- Learn

A+ Rewards

If you want to score discounts and vouchers, the Alipay+ rewards page is for you. Here, you can buy vouchers for Foodpanda, Razer, Play Store, Jollibee, Viu, Garena Shells, and more.

There are many exclusive deals you can get here each day. You can also get free vouchers from time to time. You can buy vouchers using your GCash balance.

GForest

GForest is an effort by GCash to go green. For every transaction that users make with the app, they can earn energy. They can collect a certain amount of energy and use it to plant a tree.

GCash will then coordinate with its partners and plant the tree on your behalf. You’ll also receive a certificate when you plant a tree.

On the GForest dashboard, you’ll see the available energies you’ve made from transactions. So, the more you use GCash, the more you can help the environment using GForest.

KKB

KKB or “Kanya Kanyang Bayad” is a common term that Pinoys use when eating out. Instead of paying physically, you can do it digitally with the help of GCash.

Users can set up a KKB Request where they can add people in a group with the amount they need to pay. Your GCash balance will be used when paying in KKB.

It’s a useful feature that can be great for when you’re eating out, paying for the fare, and doing activities together with a group.

Movies

Did you know that you can also watch movies in GCash through Upstream? The app lets you access many movies that you can rent for an affordable price.

It features a clean user interface where you can watch all sorts of movies, shows, and even anime. There are many titles to enjoy here, from classics to modern ones.

Activity

This is one of the main tabs in the app where you can see all your recent transactions. You’ll see the type of transaction made, time, date, amount, and reference number.

But you can also request a transaction list on a specific date range. Simply tap the envelope icon on the top, and the list will be sent to your email.

Related: GCash Receipt: Everything You Need to Know

Profile

In the Profile tab, you’ll see your information at the top. This includes your name, number, and level such as Basic – Semi Verified – Fully Verified.

There are also different tabs present here, such as:

- Profile Limits

- My Linked Accounts

- My QR Codes

- GScore

- Alipay+

- Promos

- Voucher Pocket

- Partner Merchants

- Refer Friends

- Settings

- Help

- Log Out

Some of these are shortcut buttons, but some are unique features. In the Profile Limits, you can see your wallet limit used for the month and the available remaining.

You can also link your accounts in My Linked Accounts for convenient transactions. You can then easily cash in and out using your GCash Mastercard, American Express Virtual Pay, PayPal, Payoneer, BPI, Metrobank, and UnionBank.

The GScore is a credit rating given to users based on their activity. You need to attain a certain credit rating to unlock loan features like GCredit, GLoan, and GGives.

GCash also has a refer a friend program where you can earn ₱50 for every friend referred. You can earn up to ₱1,250 per month here.

Lastly, you can contact GCash through the Help tab if you have any concerns. You can submit a ticket and receive a reply on your email.

GCash Tips and Tricks

We’ve used GCash personally over the years. During that time, we got to know some cool tips and tricks.

We’ve listed the best tips and tricks to save money. Here are they:

1. Borrow money without interest

Did you know that you can borrow money in GCash without paying interest? It’s possible when you’ve unlocked GCredit.

But the trick is to borrow and pay the amount on the same day. But once you let it go over a day, you’ll start paying interest.

2. Upgrade your wallet limit to ₱500,000 instantly!

If you want to easily upgrade your wallet limit to ₱500,000, simply link your bank account to GCash.

You can link your BPI, Metrobank, and UnionBank accounts. Linking means you can easily cash in and cash out your money from GCash to your bank account and vice versa.

3. Save money on foodpanda using vouchers

You can buy foodpanda vouchers in GCash through the Alipay+ feature. You can save up to 30% using vouchers.

The trick is to know what your total in foodpanda comes to and buy the voucher that will cover the total cost. If there’s an extra amount to pay, you need to pay it via your GCash balance for this to work.

4. Send money with a unique graphic

You may already know that sending money from your GCash to another GCash user is free. But don’t just send them as is; you can make things exciting with Send with Clip and Send Gift.

These features let you send money along with a cover photo that says Happy Birthday, Happy Valentines, and more!

You can also attach your photo, video, or audio clip for a more customized feel. So, the next time you give money to your inaanaks, use GCash to make it more modern.

5. Get exclusive GOMO load promos

Are you using GOMO? A great life hack is that you can get exclusive deals on GOMO through GCash.

Sometimes, you’ll find deals like unlimited data for 30 days or 30% off on some promos. While you can see promos in the GOMO app, in our experience, there are more promos in GCash.

Plus, the convenience of being able to buy a GOMO promo and paying through your GCash balance is unmatched.

6. Play online Bingo to get a chance to win exciting prizes

If you’re bored, why not play online bingo? We’re not encouraging you to gamble your money, but for those who love bingo, this is a great feature.

GCash has partnered with Bingo Plus, a government-registered company specializing in online bingo.

You can use your GCash balance to buy cards and cash out your earnings!

7. Link in your BPI/Unionbank account to get free cash-ins

Normally, you can cash in money to your GCash account through over-the-counter partners, online banks, and global partners and remittances.

But a quick and free way to do it is by linking your BPI or Unionbank account to your GCash. It’s easy to do, and you don’t have to pay anything when you cash in.

Plus, your wallet limit will be upgraded to ₱500,000 once you link your bank account.

FAQs

Can you use GCash abroad?

Yes, you can create and use GCash even while abroad, provided you have an active Philippine mobile number.

How many GCash accounts can I create?

You can only create one GCash account per mobile number. But you can create up to five GCash accounts registered to your name.

GCash wants to avoid fraudulent activities, which is why there’s a limit to how many accounts you can make. Besides, you only need one account in most instances.

Is GCash safe to use?

Yes, it’s generally safe to use as BSP also regulates it. But it doesn’t have a digital banking license yet, so your deposits aren’t PDIC-insured like banks.

But if you practice due diligence, there’s no reason not to use the app. Besides, you can report any scammer in GCash by submitting a ticket.

Can I get GCash without a bank account?

Yes, no requirement specifies that you need a bank account to create a GCash account. It’s a digital wallet that is used to store money, send money, pay bills, and more.

But the app rewards you with many benefits once you link your bank account, such as the increased wallet limit.

How will I know if my GCash limit is ₱500K?

You can easily check your current wallet limit by going to your Profile > Profile Limits.

There, you should see your wallet limit. If you linked your bank account to GCash, you should have a limit of ₱500k. The wallet limit resets every month.

Is GCash better than PayMaya?

Both are digital wallets, and they have similarities as well as differences. But the biggest difference is that GCash has slightly more users than PayMaya.

But what we’ve noticed is that a lot of users have accounts in both. The most common reason is to get above the smart wallet limit.

Can I use GCash to buy Bitcoin?

Crypto is a new feature coming to GCash soon. It will allow users to buy Bitcoin directly from the app aside from stocks, bonds, and money market funds.

But for now, you can buy crypto using GCash in Binance.

Is GCash for Globe only?

No, you can use it regardless of your network. This means that users with TM, Smart, Sun, Talk N’ Text, and other numbers can create GCash accounts.

Can I use GCash without data?

No, GCash can only work when you use an internet connection or data. It relies on your internet connection to make its features work in real-time.

Does GCash have a maintaining balance?

No, unlike banks, GCash doesn’t require you to have a maintaining balance. You can store your money as much as you like or leave it zero.

Final Thoughts

GCash is the number one digital wallet in the Philippines. It’s easy to use, convenient and is loaded with many features.

If you’ve made it this far, you should now know what it’s about and how to use it.

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023