Shopee PayLater is the most convenient way for you to purchase time-limited deals which everyone is trying to grab.

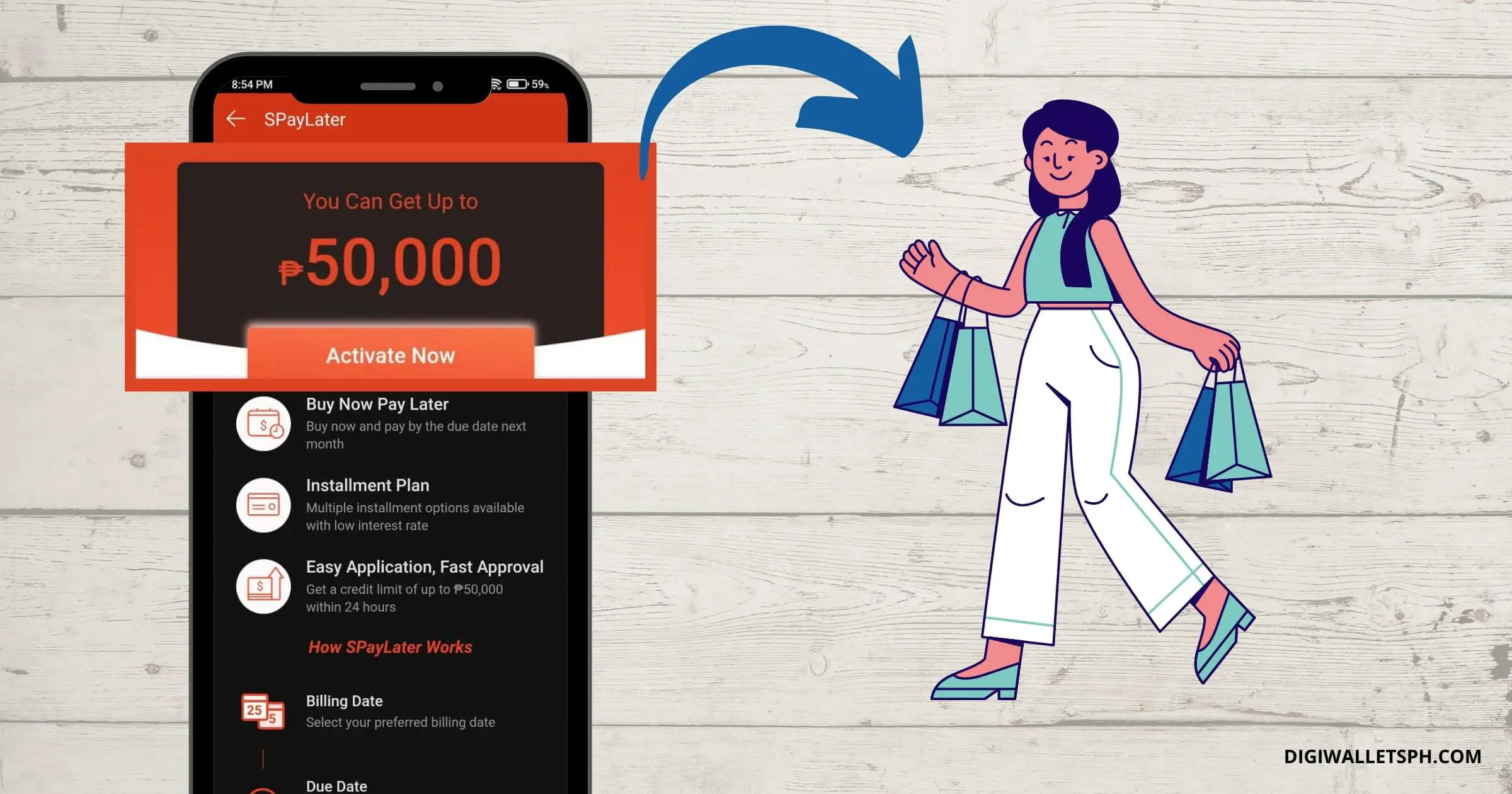

Whether it’s for convenience or you are still waiting for your salary, you can get up to 50,000 pesos of credit line which you can pay within 1 to 3 months, or even more for Platinum members.

Table of Contents

How to Activate Shopee Pay Later (Steps)

It is very easy to use SPayLater in Shopee but first, you must activate it on the app.

You must be a bona fide Filipino citizen, at least 21 years old and have at least one valid ID such as Passport, Driver’s License, UMID, Postal ID, and PRC License ID.

Step 1: Open the Shopee app and click the Me or your profile tab.

Step 2: Under My Wallet, click SPayLater.

Step 3: Click Activate Now and wait for the verification code sent to your mobile number.

Step 4: Enter the code and click Continue.

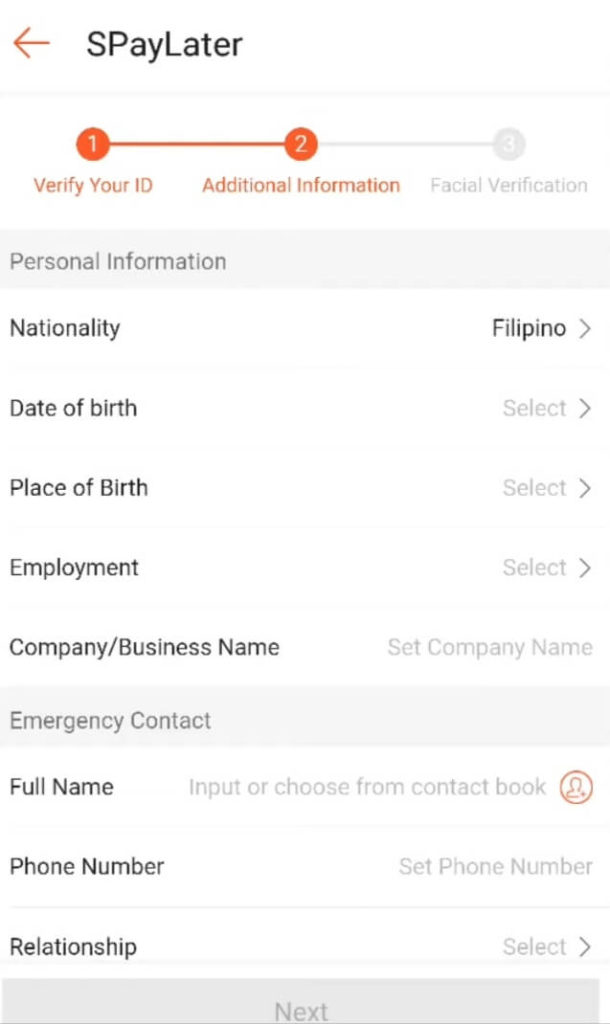

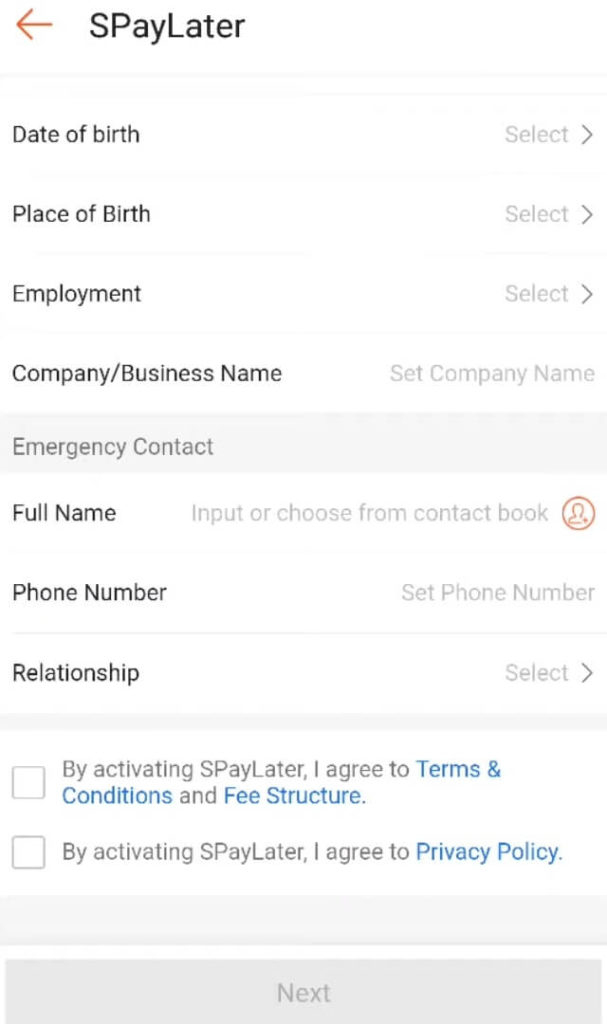

Step 5: Upload a picture of your government ID and fill out all information.

Step 6: Proceed to Facial Verification Process and wait for 24 hours to see if you are approved.

There will be an in-app notification of the credit limit approved for you, which you may already see 1 hour after application.

SPayLater Interest

The interest ranges from 1 to 5% of the total order amount, which is based on your personal credit profile.

Take note that there is a zero to 2% processing fee of your order, and this is separate from the interest.

Shopee automatically decides on the interest range based on the type of items as well as the number of instalments.

If you fail to pay your dues on time, there is a 2.5 to 5 percent corresponding late fee.

SPayLater Credit Limit

If you’re wondering how much credit limit you can get with SPayLater, it depends on a lot of factors.

If you just activated it, then you’ll probably receive a credit limit of anywhere between P1,000 – P20,000 or more.

Then as you use SPayLater more and pay your dues on time, then they’ll naturally raise your credit limit.

SPaylater Payment Terms

Shopee lets you choose different payment terms depending on your preference.

They let you select when to pay the loan amount from 1 month up to 3 months.

If you’re a platinum member, you can choose up to 6 months.

Obviously, the longer your repayment terms are, the higher interest you’re going to pay.

As mentioned above, the interest rate is 1-5% on total order.

How to use SPayLater (Steps)

You can use SPayLater to pay for your Check Out orders by following these steps:

Step 1: Select the items in your Shopping Cart that you want to buy.

Step 2: Apply Vouchers, Cashback, and Redeem Shopee Coins before you proceed to Check Out.

Step 3: Go to Payment Options and click on SPayLater.

Step 4: Choose from Buy Now Pay Later, Instalment 2x, or Instalment 3x and click Confirm.

Step 5: Check your order details once again and click Place Order.

Step 6: Wait for the verification code and enter it before clicking Continue.

You can check your remaining balance by going to SPayLater where you can see your bills and latest transactions.

How to pay SPayLater

You can pay the amount spent using SPayLater before or after you receive your bill:

Step 1: Open the Shopee app and go to the Me tab.

Step 2: Click on SPayLater and go to My Bills.

Step 3: Go to Upcoming Bill just in case you want to pay early, but if you already received your billing, go to Current Bill.

Step 4: Click Pay Now and choose between ShopeePay, Payment Center, e-Wallet Online Banking, or Over-the-Counter options as your payment method.

Step 5: Click Confirm and follow any additional steps as prompted.

Always pay on or before the due date in order to not receive the penalty for late fees.

What happens if you don’t pay SPayLater?

If you fail to pay SPayLater in Shopee, your credit line will be cut, and you will not be able to reactivate it until you paid off your outstanding balance.

Shopee also reserves the right to disable other Shopee Vouchers and Discounts, even if they do not require Shopee Pay.

The worst things that could happen may include: your account being disabled, a visit from a collection agent, and your credit score being negatively affected for any future loan.

How to pay SPayLater via GCASH

It is very easy to pay the amount due using GCash:

Step 1: Click the Pay Now button inside the SPayLater page in the Shopee app.

Step 2: Go to Payment Method and select Payment Center / e-Wallet.

Step 3: Select GCash from the options and click Confirm.

Step 4. Click the Pay Now button and enter your email if it is blank.

Step 5: Enter your GCash mobile number, click next, and enter the verification code.

Step 6: Login to your account and click the Pay button with the indicated amount.

You should receive a notification that your payment is successful.

How to increase SPayLater limit?

The credit limit on your SPayLater depends on your credit score as deemed by Shopee but it might be affected by your other outstanding loans.

As far as Shopee is concerned, you can increase your credit limit by making sure that you pay on time and you use SPayLater frequently for your purchases.

One trick is to always use ShopeePay rather than COD or other payment methods.

Why don’t I have SPayLater?

Shopee PayLater is only available to select users, who should see an invitation in the app.

If you are not yet qualified, try to increase the frequency and the amount of your Shopee orders in order for Shopee to recognize you as an eligible customer.

Are there SPayLater deals?

Shopee PayLater allows you to divide your payment into more affordable installments.

There are additional free shipping vouchers as well that can be applied if you choose SPayLater as your payment method.

How to deactivate SPaylater?

The simple answer is you can’t.

Once you’ve activated it, you can’t remove this feature from the app.

You can just choose not to use it when paying for your order in Shopee.

The good thing is that you won’t be charged anything even if this is activated if you don’t have any unpaid loans.

Conclusion

SPayLater by Shopee is a great payment option to use whether you need a fast transaction or you are still waiting for your salary.

It can also be a way for you to prove that you are a responsible consumer who pays dues on time.

Related posts:

- How to use Gcredit in Shopee: 4 Easy Steps

- How to Pay Shopee Using GCash: Full Guide

- How to Transfer Shopee Pay to GCash: Full Guide

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023

2 thoughts on “SPayLater in Shopee: Approval, Limits, & Interest”

Comments are closed.