Is your Home Credit bill due?

You don’t have to get out of the house to pay it when you can do it through GCash.

Check out how to do it in the guide below.

Table of Contents

Steps on paying Home Credit via GCash

Follow these instructions on how to pay Home Credit via GCash:

Step 1: Open the GCash mobile app on your smartphone.

Step 2: Go to the Pay Bills section.

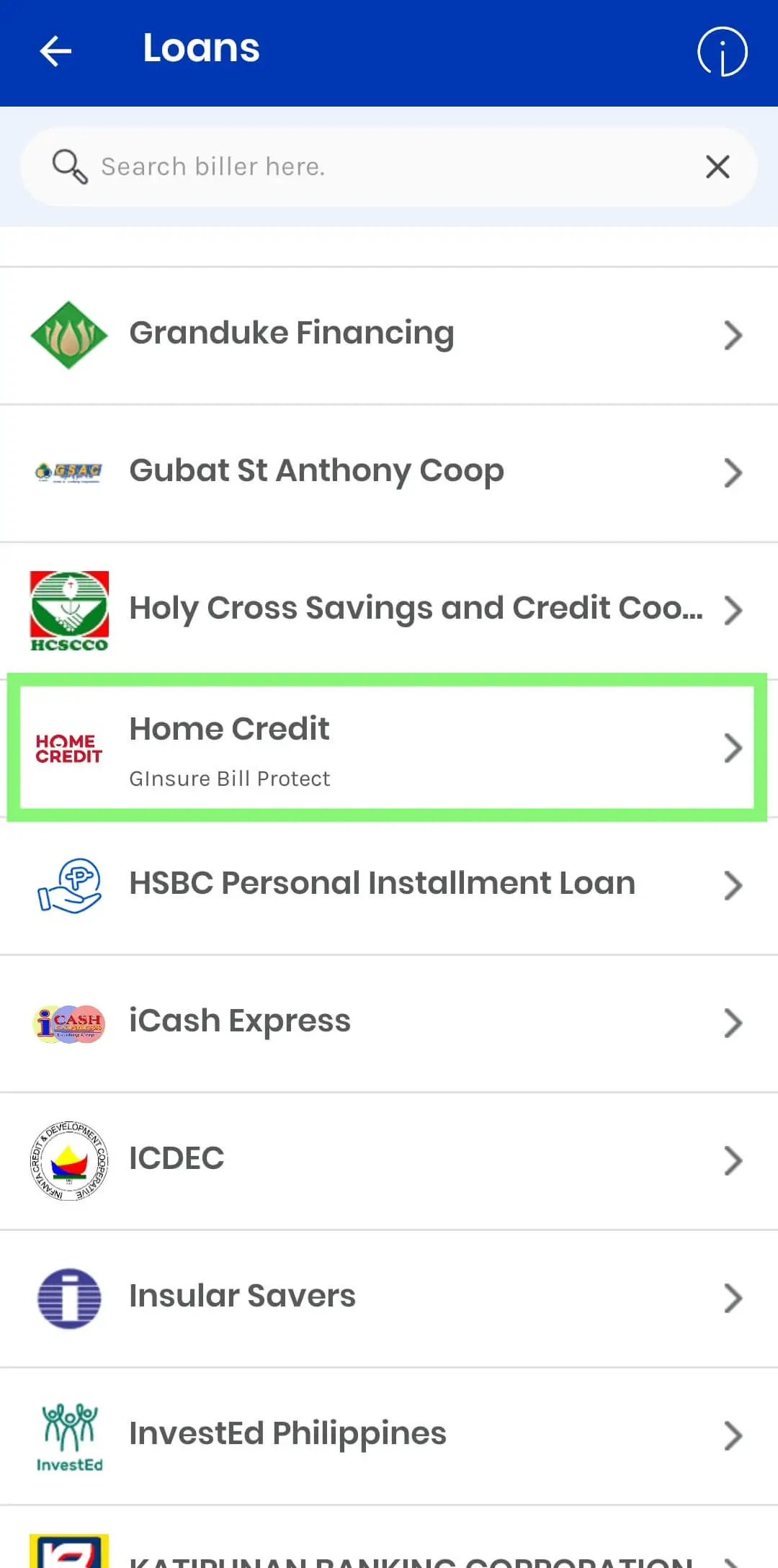

Step 3: Tap on Loans or search directly for Home Credit.

Step 4: Input your contact number, mobile number, amount, and email (optional).

Step 5: Click on Next and recheck the details before tapping on Confirm.

You may also opt to avail of the GInsure Bill Protect offered by GCash for a minimal amount that serves as AD&D insurance in case of unfortunate events.

Can I pay Home Credit using GCredit?

Unfortunately, GCredit is not an option to pay for Home Credit, and you can only use your GCash balance.

Even when available, take note that GCredit has a slight interest too.

Is there a fee when paying Home Credit using GCash?

Yes, there is a P15 fee when paying Home Credit using the GCash app.

Before confirming your payment, it is not immediately displayed but is added to the final receipt.

As such, your payment will not proceed if you have the exact amount in your GCash wallet.

What is Home Credit?

Home Credit is a top-rated loan product company for those who want to buy an expensive item but cannot pay the whole price upfront.

It offers a buy now, pay later scheme where the customer pays a fixed monthly fee until their purchase is fully paid.

The target customers are those with no substantial credit history but otherwise have a reliable source of income.

Home Credit offers 0% interest promos for select products, which is also a win for the stores offering them. Previously, Home Credit was only non-cash, but now, it provides cash loans.

FAQs

How many months can I pay my Home Credit loan?

If you availed of a mobile phone, it could be paid in 6, 9, or 12 months.

Otherwise, you can choose up to 15 or 18 months to complete your installments.

This will always be discussed with you and should appear on your contract that is customizable.

What types of products can I buy with Home Credit?

You can buy the following products with financing from Home Credit, as long as they are being offered by a store or the Home Credit Marketplace:

- Appliances

- Cellphone

- Computers

- Furniture

- Musical Instruments

- Scooter

- Sporting Goods

- TV or Electronics

Can I buy multiple items at the same time?

You can only buy three items at a time under Home Credit as long as they are under different product categories.

For example, you cannot buy three phones, but you can buy a phone, laptop, and TV simultaneously.

However, any purchase is still subject to approval, so you should build first or maintain your good standing with Home Credit to avail multiple loans simultaneously.

What is Home Credit Marketplace?

The Marketplace of Home Credit shows various items, including bestsellers and hot deals.

You can check participating items at https://homecredit.ph/marketplace/.

Does Home Credit Marketplace offer delivery?

No, all items displayed in the Marketplace are actual items from stores, so you need to pick them up.

You can personally arrange shipping for your item at your own expense if possible and more convenient than going to the store.

Does Home Credit need downpayment?

Yes, it would help if you made a downpayment whenever you avail of a Home Credit deal, but you can decide what amount you want to pay.

If you want to avail of the 0% interest promo, you must pay at least 40% of the item price.

It’s better to pay more upfront to save on other fees.

What is Home Credit Cash Loan?

The cash loan product is invitational or exclusive only to Home Credit customers in good standing.

This means that you have been with Home Credit for a while now, and you have paid your installments on time.

You can instantly avail of the cash loan from P10,000 to P150,000 through the My Home Credit app, telesales, or partner stores with just two valid IDs.

It is payable for 18, 24, 30, or 36 months, with the monthly interest rate indicated on your contract.

Home Credit advertises a low-interest rate, so this is below 5%.

What are the fees I need to pay with Home Credit?

When you buy a product, there will usually be a few things that you need to pay for:

- Downpayment amount

- Origination, or equivalent to a processing fee of 3% of the product price minus the downpayment

- Interest

Your monthly installments will be equal, and they are composed of the remaining amount not yet paid plus the interest.

The downpayment and origination or processing fee are always paid before purchasing your item.

What is the difference between 0% interest and free last payment?

The 0% interest and free last payment are different promos, and they cannot apply simultaneously.

0% means that you will just be dividing the amount of the product that you could not pay the downpayment for by the number of months in your contract.

Logically, free last payment is offered when you have paid all previous installments, so it looks like you have already paid for the item, and that last payment covers interest.

However, you will need to pay the last payment if you missed anyone’s previous installment, even by just a single day.

To put it shortly, avail of 0% interest when you can; otherwise, pay on time to save on interest fees.

This encourages you to be a responsible consumer and a certified Home Credit customer.

Which products have 0% interest and free last payment?

Usually, items with more than P10,000 will be offered for the 0% interest promo.

On the other hand, free last payment is offered for items worth less than P10,000.

Note that the two promos do not automatically apply to all of the items covered by Home Credit.

You still need to look for promotions and ask the staff for possible payment options.

The details can be checked in the contract that you will sign.

Conclusion

Home Credit makes loan products more accessible to Filipinos who do not have other means of getting a loan.

You can avail of Home Credit deals to build your credit history and quickly pay using GCash.

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023

1 thought on “How to Pay Home Credit via GCash: Full Guide”

Comments are closed.