After successfully applying for an SSS loan, you now need to pay your monthly amortization.

GCash is a reliable way to receive your loan proceeds and send payments to SSS.

If you want to know how to pay an SSS loan using GCash, check out all the detailed information in this article.

Table of Contents

Is it easy to pay SSS using GCash?

It is easy and secure to pay for your SSS loan using GCash.

If you already have your SSS payment reference number, you can go straight to GCash to make the payment.

Even your kid can do it by following the steps in the next section.

How to pay SSS loan using GCash

Here are the steps on how to pay an SSS loan using GCash:

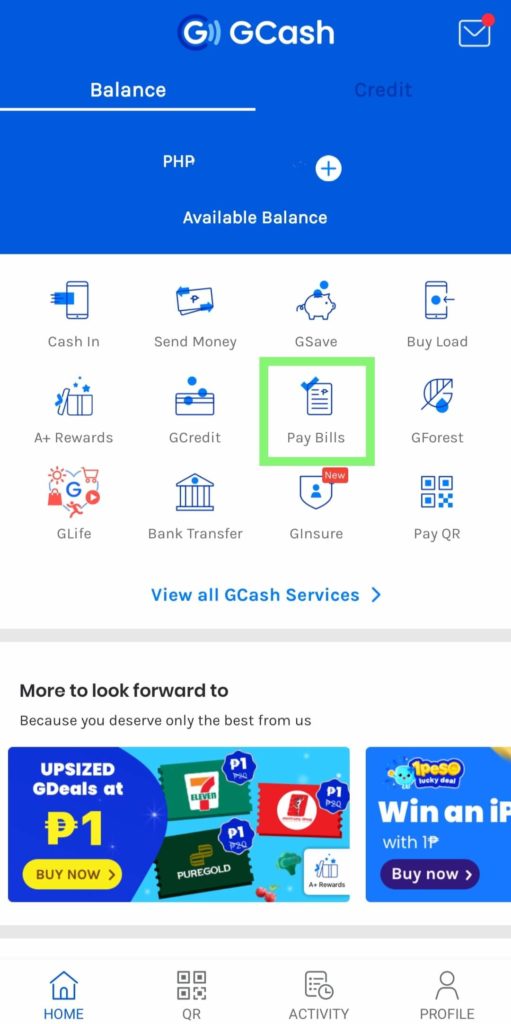

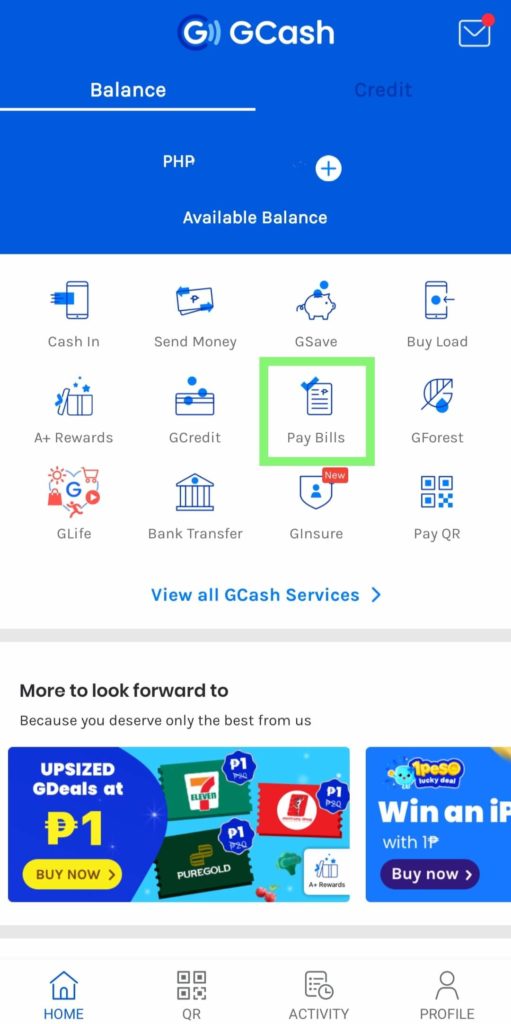

Step 1: Open the GCash app on your smartphone and select Pay Bills

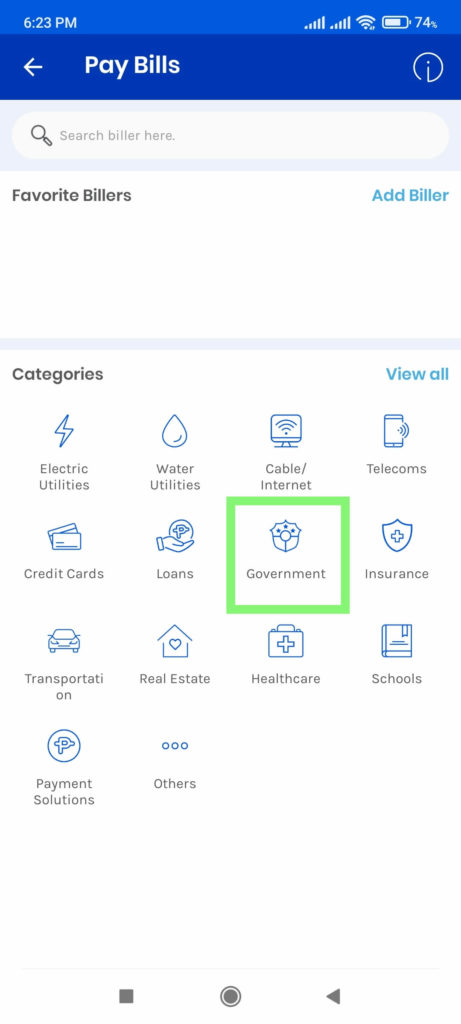

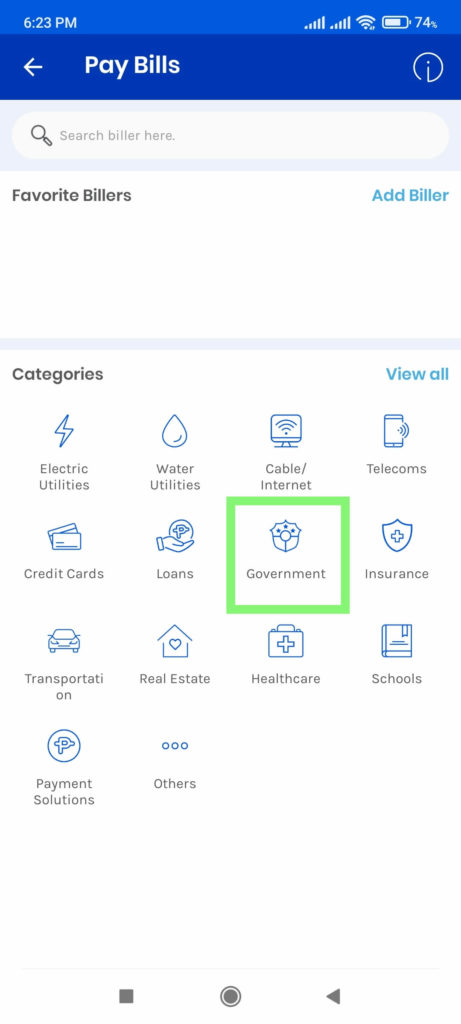

Step 2: Go to the Government section

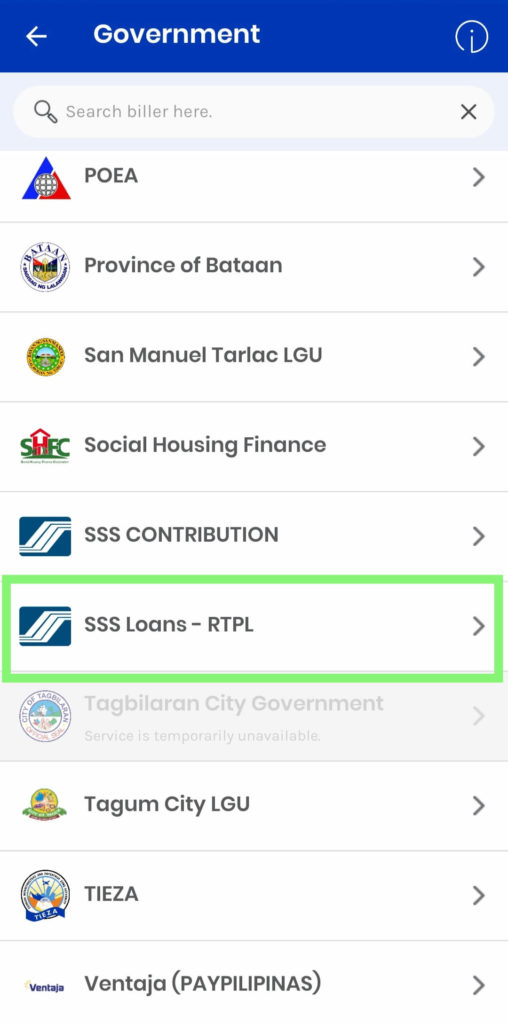

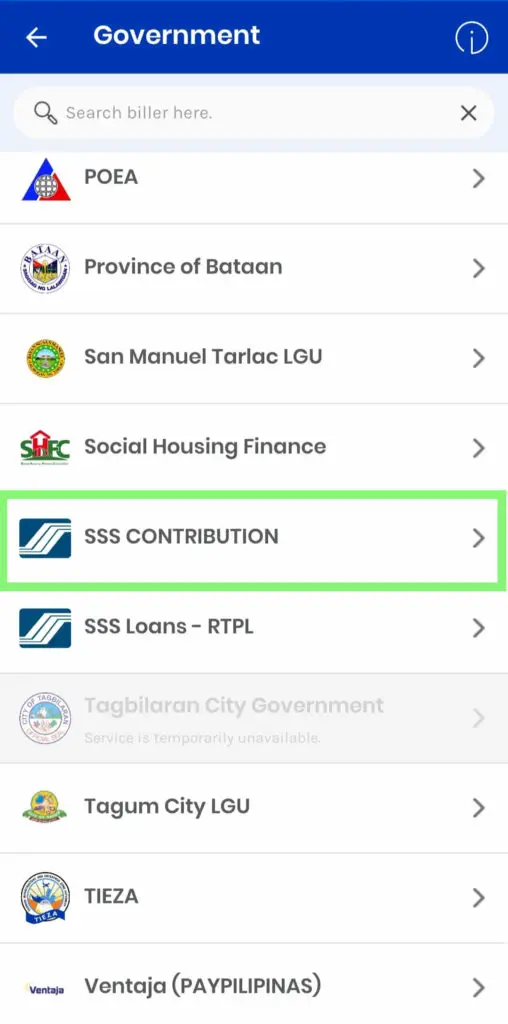

Step 3: Search for or scroll down to SSS Loans – RTPL.

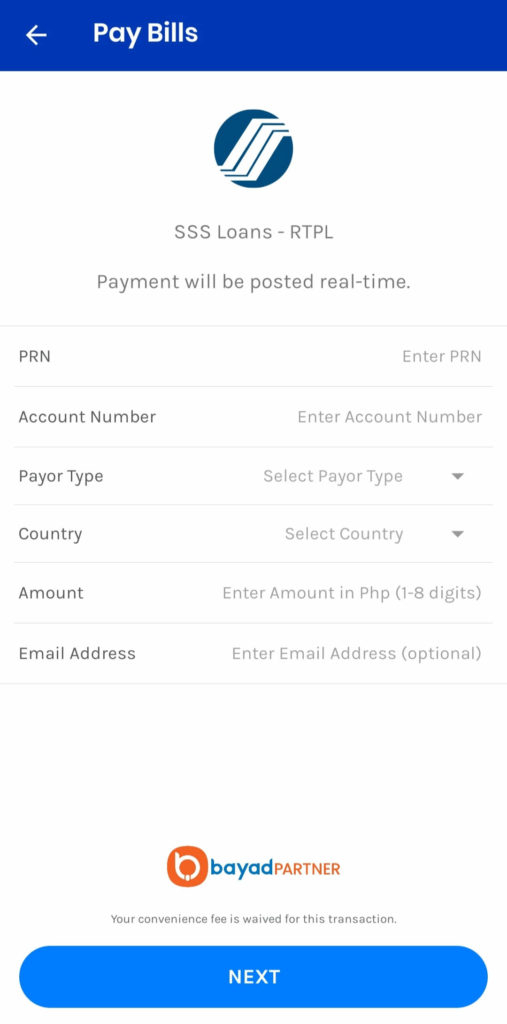

Step 4: Enter your PRN, SS Account Number, Payor Type, Country, amount, and email address (optional).

Step 5: Click Next and check all the details before confirming the payment.

You can now wait for the notification message of successful payment.

What is SSS RTPL?

The RTPL of the Social Security System means Real-Time Processing of Loans.

This means that once you make a payment, it will immediately be posted in the system of SSS rather than waiting for a few hours or even days.

You can ensure that you can meet the payment deadline to avoid penalties, especially when you can only pay on the due date itself.

How to get PRN for SSS loan

Follow these step-by-step instructions on how to get the payment reference number for your loan:

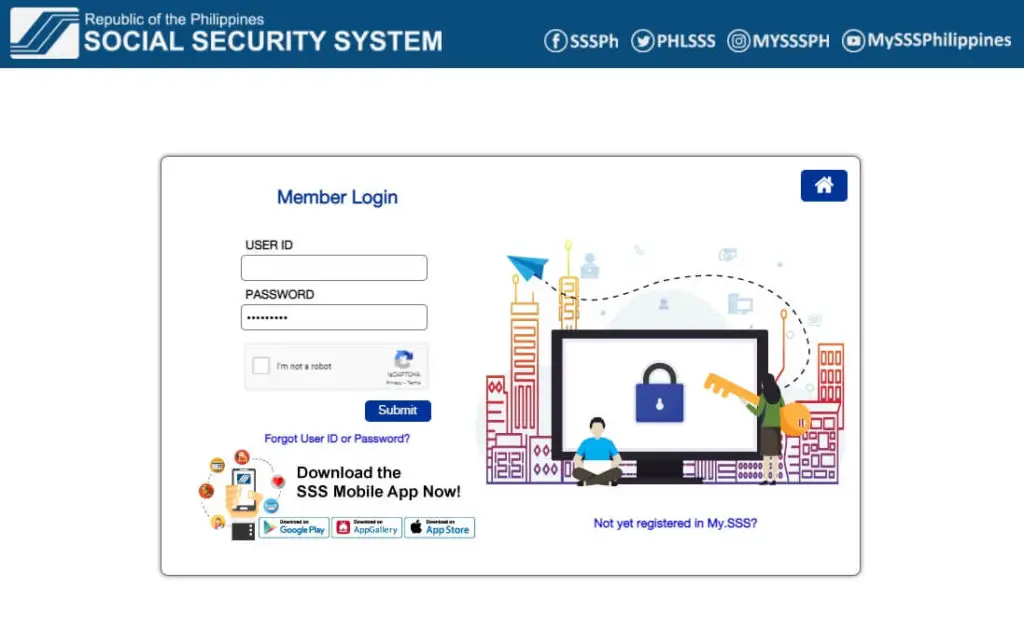

Step 1: Go to https://member.sss.gov.ph/members/.

Step 2: Log in to your account.

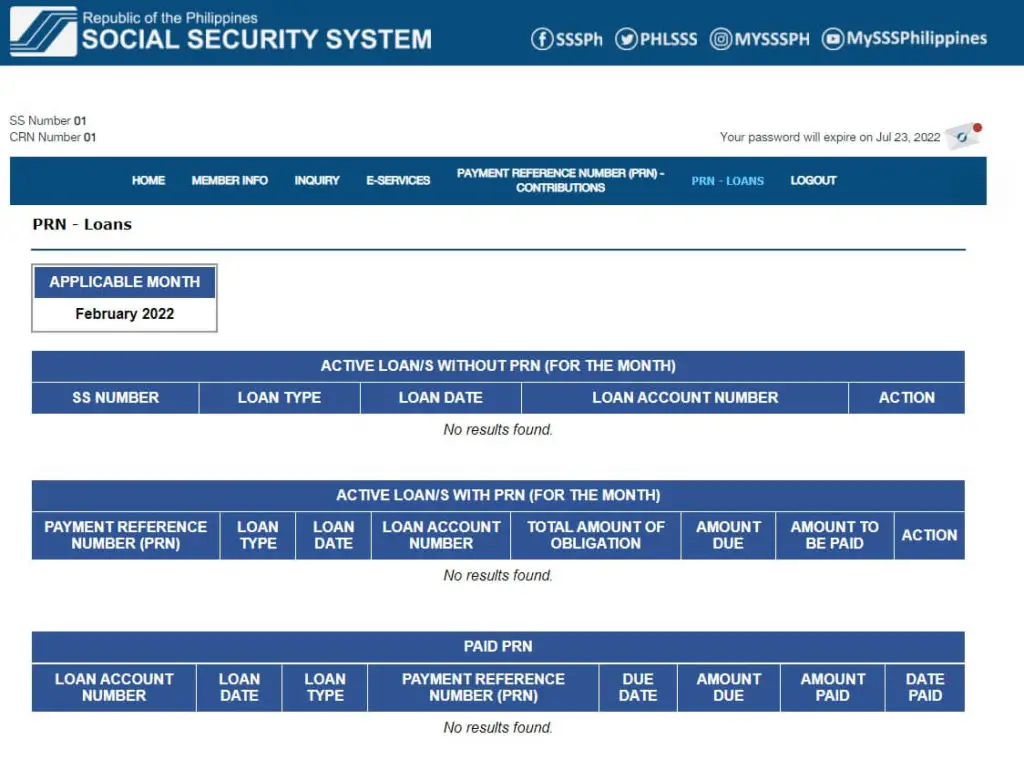

Step 3: Click the RTPL PRN tab.

Step 4: Check the amount to be paid and enter the amount you want to pay.

Step 5: Tap the Save All button if you have edited the amount.

Step 6: Clicking the PRN button.

Step 7: You can print or take note of your payment reference number.

Please note that your SSS PRN is different from the SSS RTPL PRN when used for transactions.

What if RTPL PRN says Error Message?

If you encounter this message, try to log out first, then log back into your account.

Your SS number may have no active Payment Reference Number because the system has not generated it yet.

Try to log in later or after a few days when the system may finally have been updated to include the PRN for your loan.

How to get PRN for SSS loan via call

If you have problems with your PRN, you can call the SSS Helpline for assistance or even get your PRN.

They can be contacted through the telephone numbers 920-6446 to 55 or 1-800-10-2255-777 (toll-free).

How to get PRN for SSS loan via email

If you are experiencing problems or have other concerns, you may email PRNHelpline@sss.gov.ph and indicate your name, SS Number, details, and SSS ID or valid IDs.

How to get PRN for SSS loan via SMS

SSS will automatically send a PRN to your registered mobile number if you are not under an employer.

You can also follow these steps:

Step 1: Open the SMS app on your phone.

Step 2: Type SSS<space> REG<space> (SS Number)<space> (mm/dd/yyyy format of birthdate).

Step 3: Send it to 2600 for registration.

Step 4: Take note of your SSS pin.

Step 5: Type SSS<space> PRN<space> (SS Number)<space> (PIN)<space> (mm/dd/yyyy format of birthdate).

Step 6: Send the message to 2600.

Take note that texting SSS requires P2.50 regular load per message.

Also, check whether your PRN is for your membership or loan payment.

You should receive this monthly, but you can always generate a PRN via the SSS website, Mobile App, or other aforementioned methods.

How to pay SSS contribution using GCash

Don’t forget that you still need to pay your SSS contribution even though you already paid for your SSS loan.

Follow these steps on how to pay SSS contribution using GCash:

Step 1: Generate your PRN using the SSS Mobile App or the My.SSS website.

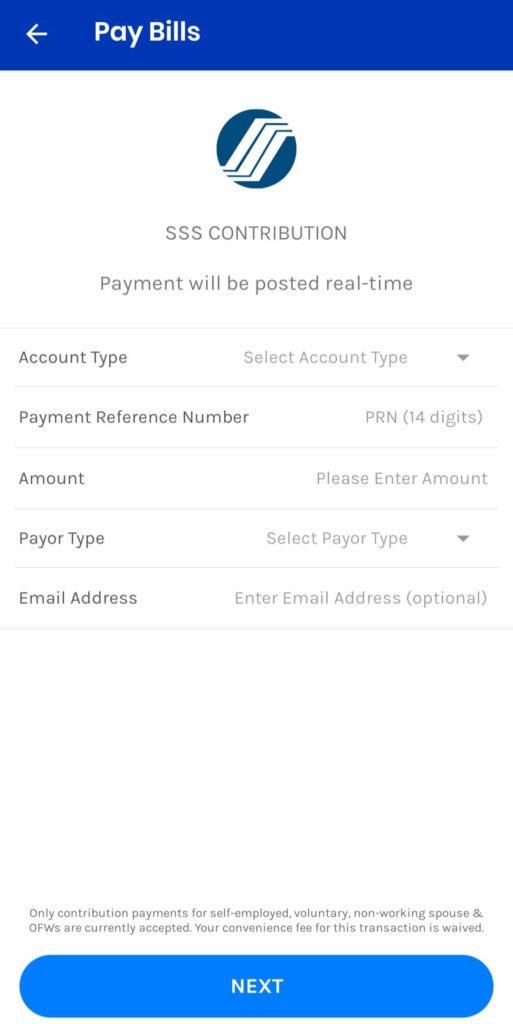

Step 2: Go to the GCash app on your smartphone and select Pay Bills

Step 3: Proceed to the Government section

Step 4: Search for or scroll down to SSS CONTRIBUTION.

Step 5: Enter your Account Type, Payment Reference Number, Amount, Payor Type, and email address (optional).

Step 6: Tap Next, then check all the details.

Step 7: Click on the Confirm button.

You should receive a notification message of successful payment and the GCash payment receipt.

How much is the fee when you pay SSS using GCash

With GCash, you do not have to pay a transaction fee, convenience fee, system fee, late fee, or any other fee when paying for SSS.

When entering the details of your SSS payment, you can already see that the transaction fee amount is 0.00.

However, if you decide to pay using the E-Payment Services of SSS either on the website or the mobile app using your GCash Mastercard, there is a fee of 1.75%.

This means that for every P1000 payment, there will be a P17.50 fee if you use any credit or debit card under BancNet.

It is better to pay using the GCash app to avoid extra fees.

Can you pay the SSS loan past due using GCash?

Yes, you can pay your SSS loan using GCash, whether on time or past the due date.

However, you may opt to generate a new payment reference number to include the one percent penalty fee instead of generating another PRN just for the penalty amount.

Other ways to pay SSS loans online

If you still do not have the GCash app, you can pay directly on the SSS app or website using your PayMaya account or a BancNet debit or credit card.

There is a P10 fee for PayMaya and a 1.75% convenience fee for BancNet cards.

Moneygment does not need your payment reference number to make a payment.

You can also use CIS Bayad Center Coins.PH, Security Bank DigiBanker.

These banks also accept payments for SSS, so you should check if you need to enroll in SSS first:

- Asia United Bank

- Bank of Commerce

- Banco de Oro

- Bank of the Philippine Islands

- PNB Savings Bank

- Union Bank of the Philippines

- United Coconut Planters Bank

How to check online if your payment has been posted

To check if the recent payment for your SSS loan has been posted, you need to visit the My.SSS website or use the SSS Mobile App.

Step 1: Open the SSS Mobile App on your smartphone.

Step 2: Click the Plus sign on the home screen.

Step 3: Tap on the Loan Balance and check whether it has been updated from your last payment.

You can check the posted payments by visiting the My.SSS website:

Step 1: Log in to your account at https://member.sss.gov.ph/members/.

Step 2: Click on Loans Info under the Inquiry tab.

Step 3: Look for your loan under the List of Availed Loan(s), then click it.

Step 4: Scroll down to Credited Payments.

You can now see the posted payments for your SSS loan.

Do I need to pay the exact amount for SSS via GCash?

While it is always an excellent measure to pay the exact amount, it is okay to pay a more significant amount, especially if you are in a hurry and forgot the amount due.

However, you need to enter the exact amount to pay for a consolidated loan.

It is best to call SSS to know what to do best since you may apply for a refund, or the overpayment may automatically be credited to your next loan payment.

What happens if I stop paying SSS contributions while I have a loan?

If you stop paying your SSS contributions, you will get a notification from SSS that you have a payment due.

You can only stop paying your monthly contributions if you have no earnings as a self-employed or voluntary member.

Take note that you still need recent monthly contributions if you want to apply again for an SSS loan in the future.

You cannot pay for missed months later, and it may affect your SSS benefits.

When is the deadline for paying the SSS loan?

Once your loan application has been approved, your first payment will be on the month following next month.

For the actual date, check out this table of schedules:

| 10th digit of SS number (HR/ER number if employed) | Day of the month |

| 1 or 2 | 10th day |

| 3 or 4 | 15th day |

| 5 or 6 | 20th day |

| 7 or 8 | 25th day |

| 9 or 0 | Last day |

If you are a self-employed or voluntary member, the payment can be quarterly.

Can I also pay SSS if I have an employer?

If you have an employer and you processed your loan application through that employer, they will be the one to pay your monthly amortization.

You also cannot access the RTPL PRN using your account because your employer is handling it since they are required to do so.

Can I reuse the RTPL PRN from SSS for future payments?

You cannot reuse your RTPL PRN for future payments because a new one is generated from the 1st to the 6th day of the following month.

You can automatically receive the RTPL PRN via email or SMS notification, but you can also edit the amount to pay by going to the My.SSS website.

Does GCash get errors with payments to SSS?

It is rare to get an error with GCash, but here are some scenarios and what to do:

- You cannot use the Pay Bills feature – there is system maintenance, and you can wait or look for other options to pay

- You have entered the wrong details – contact GCash via hotline or submit a request ticket

- I have successful payment, but it is not reflected in my SSS account – contact SSS

Can I still use PRN if I miss the payment deadline?

Yes, you can still use your current PRN even after missing the payment deadline but take note that it only corresponds to the amount entered before generating it.

Don’t forget that it becomes invalid after the new PRN is generated in the following month, so you should download a new RTPL PRN.

What types of SSS loans can I pay with GCash?

As long as you can generate or already have a payment reference number from SSS, you can send your payment using the Pay Bills section of GCash.

Note that the RTPL is only available for short-term loans of SSS since it is also mandatory.

These loans are Calamity, Emergency, Restructured, and Salary Loans.

Can I pay my SSS loan in advance?

You can pay a part of the whole amount of your SSS loan’s outstanding balance.

You need to enter the amount you want to pay and save it before generating your PRN through the SSS website.

By doing so, you save on the interest of your remaining outstanding balance.

Who should pay my SSS loan if my employment ends?

If you resign, get terminated, or other reasons that you are not with your employer anymore, you should talk to HR regarding the arrangement.

You can opt to pay for the remaining monthly amortizations yourself, but you can also opt that they deduct the amount from your separation pay or remaining salary.

Conclusion

It is very affordable to pay your SSS loan because it is spread into 24 months of payment.

Pay your SSS loan with GCash so you’ll never miss a due date and avoid penalties.

Other helpful guides:

- How to Pay SSS Online Using BPI: Step-by-Step Guide

- How to Pay Home Credit via GCash: Full Guide

- How to Pay PhilHealth Contribution Using GCash

- How To Use Grab Vouchers - December 27, 2023

- How To Transfer Gcash To Maya - December 27, 2023

- How To Recover Gcash Account - December 27, 2023